Slowing coronavirus spread calms US and European markets

The slowing spread of coronavirus has calmed stock markets in the US and Europe, easing one of the most turbulent periods of trading on record.

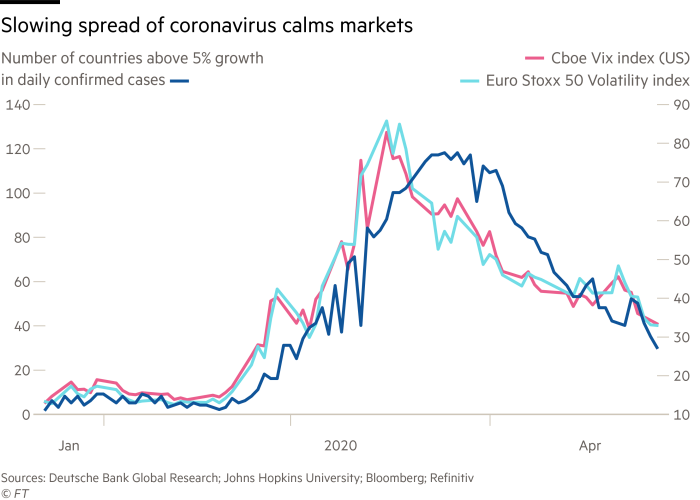

The Cboe Vix index, which tracks volatility in the US stock market and is known as Wall Street’s “fear gauge”, has fallen from the record high set in March as markets digested the effects of the pandemic.

The Euro Stoxx 50 Volatility index, which tracks the region’s top 50 companies, has also dropped sharply from its March level, which was its highest point since the financial crisis.

The indices have eased as the number of countries with a daily growth rate in infections above 5 per cent has fallen in recent weeks.

The virus has affected millions of people around the world and sent economies into lockdown as governments impose measures to contain its spread. The drop in activity has hurt businesses, leaving millions of people without work and prompting governments and central banks to intervene with trillions of dollars in relief.

“When the virus was accelerating around the world, the uncertainty pushed the Vix to an extreme that led the Federal Reserve to step in,” said Torsten Slok, chief economist for Deutsche Bank Securities. “As the Fed has provided more support and the virus curve has flattened, the uncertainty has begun to fade.”

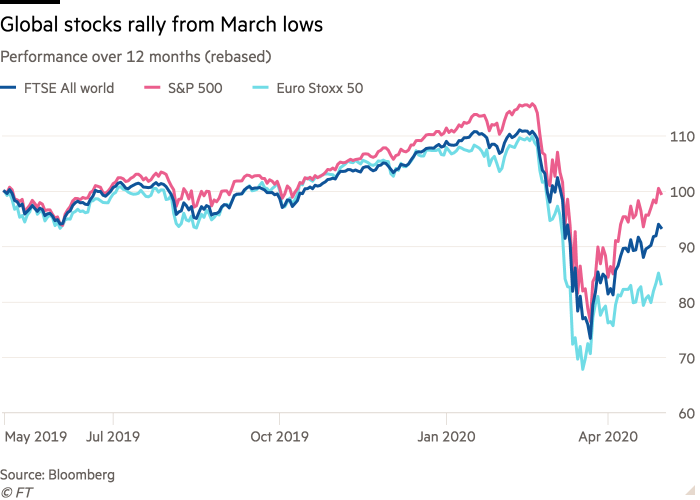

The drop in volatility helps to explain the equity market rally that pushed the US stock market to its best month since 1987 in April, and the FTSE All World index to the best month since 2011.

“Some people are still worried, but others see light at the end of the tunnel,” said Gabriel Grego, founder of Quintessential Capital Management. “Even though there is a huge amount of fear and uncertainty, I think we are past the acute part of the crisis.”