Blackstone Mortgage: Get 8% Passive Income From This Trust Gem (NYSE:BXMT)

Vertigo3d

Blackstone Home loan Have faith in, Inc. (NYSE:BXMT) is a well-managed authentic estate finance organization that pays a regular dividend that is entirely protected by distributable earnings.

The home finance loan have confidence in also has important upside to fascination charges, which is turning into a bigger concern for traders now that the central financial institution has delivered two large 75-foundation-stage dividend hikes in the very last two months.

Black Property finance loan is an interesting passive income investment decision because of to the passive profits and ongoing energy in originations.

Demand For New Originations Is Sturdy

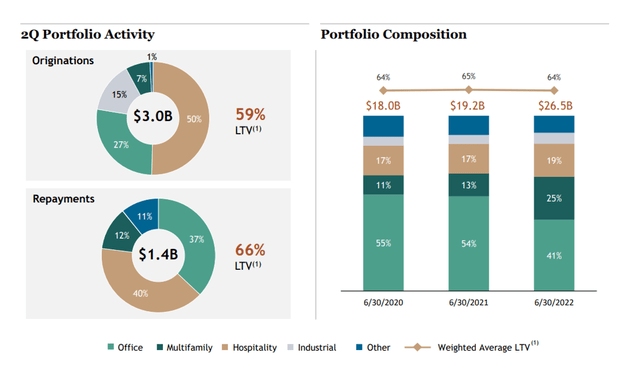

In the second quarter, Blackstone Mortgage originated $3. billion in new professional true estate loans, up from $3.4 billion in the preceding quarter. The average mortgage to benefit ratio for Blackstone Mortgage’s 2Q-22 originations was 59%, with a financial loan sizing of $313 million.

The mortgage to value ratio is a danger measure for real estate trusts that reveals how substantially leverage an trader is dealing with on an asset level. A financial loan-to-worth ratio of 59% is reduced and suggests a moderate level of threat in Blackstone Mortgage’s portfolio.

As of June 30, 2022, the trust’s portfolio weighted normal financial loan to worth ratio was 64%. The trust’s financial commitment portfolio elevated to $26.5 billion after subtracting $1.4 billion in 2Q-22 repayments.

2Q Portfolio Exercise (Blackstone Home finance loan Have confidence in)

Potent Foundation To Support Advancement

Industrial real estate markets in the United States are executing nicely, which is why Blackstone Home loan anticipates strong demand from customers for new originations.

Blackstone Mortgage loan is sponsored by Blackstone Inc. (BX), the world’s major different asset manager with $941 billion in property under management. Blackstone Home finance loan added benefits from its affiliation with its sponsor by sourcing new discounts via its extensive market network.

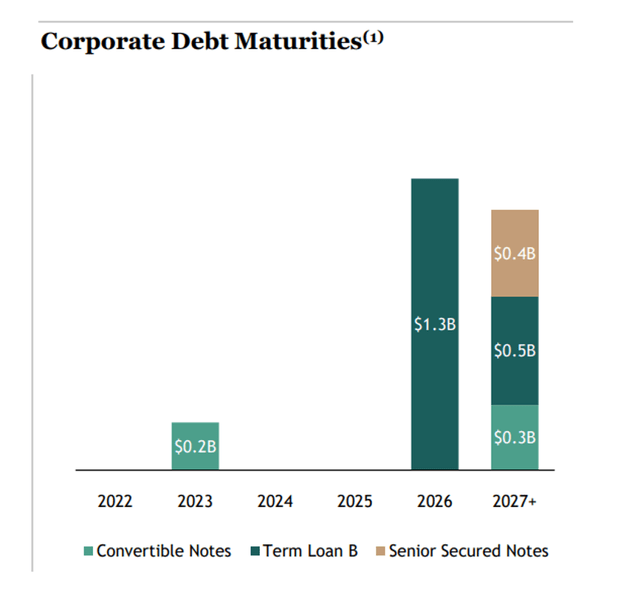

Blackstone Home loan also has entry to substantial liquidity resources, permitting it to capitalize on expense alternatives. On its stability sheet, Blackstone had $284 million in money and funds equivalents and $1.5 billion in liquidity access. Apart from $200 million that must be repaid in 2023, Blackstone Home finance loan has no maturing financial debt right until 2025.

Corporate Personal debt Maturities (Blackstone Home loan Rely on)

Dividend Is Coated By Distributable Earnings, Earnings Upside

Dividends are consistently coated by distributable earnings in powerful trusts. By executing so, they give shareholders self esteem that the dividend will be compensated even if the serious estate market or the entire economic climate suffers a downturn.

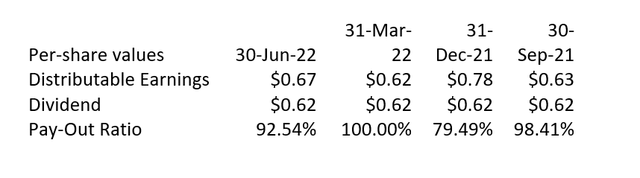

Blackstone Mortgage’s financial commitment financial loans generated $2.70 for each share in distributable earnings above the past twelve months, even though the have faith in compensated out $2.48 for every share, implying a shell out-out ratio of 92%. Due to the fact of better earnings from the trust’s financial loan portfolio, the shell out-out ratio improved QoQ.

Pay out-Out Ratio (Writer Created Table Utilizing Believe in Data)

According to the dividend payout ratio, Blackstone Mortgage loan has a reasonable margin of safety and will most most likely be equipped to sustain its dividend fork out-out in the foreseeable future.

An Added Benefit: Earnings Upside

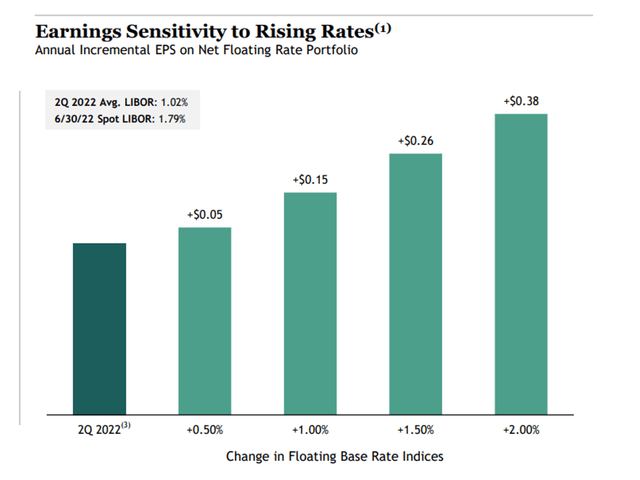

The harmony sheet of Blackstone Home loan is positively correlated with desire premiums, which is a helpful feature specified that the central financial institution has begun to elevate fascination premiums aggressively in the final two months, with two again-to-back again 75-foundation-stage hikes aimed at made up of inflation.

The trust’s genuine estate loans’ positive correlation with fascination charges translates into earnings expansion for Blackstone Property finance loan. In accordance to the trust’s most latest earnings sensitivity desk, Blackstone Home finance loan expects earnings for every share to rise to $.38.

Earnings Sensitivity To Increasing Charges (Blackstone Mortgage loan Belief)

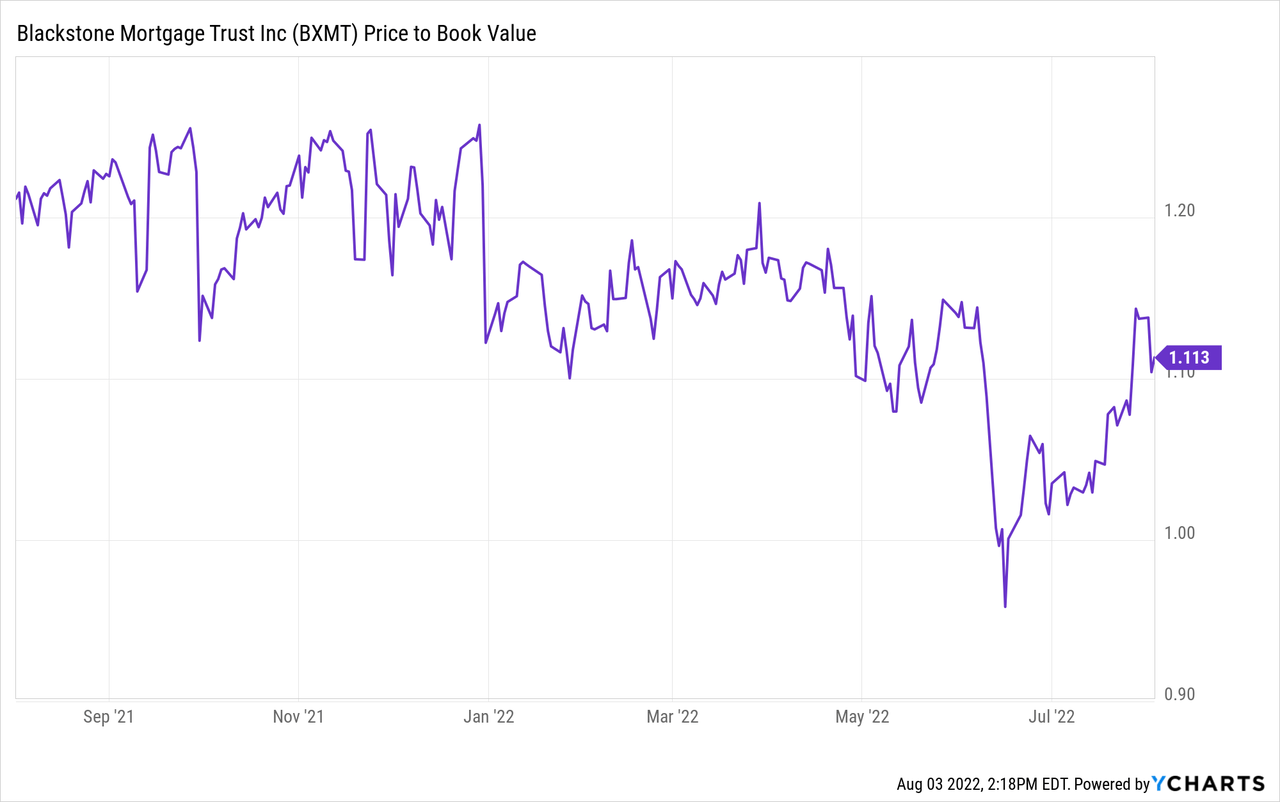

P/B-A number of

At $31 for each share, you don’t obtain Blackstone Home loan for funds appreciation you buy it for the 8% passive cash flow coated by distributable earnings. On June 6, 2022, the trust’s e-book price was $27.17, representing a 14% premium to e book benefit. For the bulk of 2022, Blackstone Mortgage’s inventory has traded at a 14% high quality.

Why Blackstone House loan Trust Could See A Lessen Stock Cost

2nd-quarter originations, a solid earnings trajectory, and an enhanced spend-out ratio demonstrate the energy of Blackstone Mortgage’s fundamentals. However, this could modify. Through a economic downturn, origination volumes commonly lessen significantly as serious estate buyers and builders lower again on new projects and focus on holding current initiatives afloat.

A economic downturn could have an impression on Blackstone Mortgage’s book value advancement and potential to increase distributable earnings via new originations.

My Conclusion

Blackstone Mortgage’s originations remained resilient in the second quarter, attesting to the strength of the professional actual estate marketplace and indicating that the trust’s origination business enterprise is not nevertheless affected by a recession.

Blackstone Mortgage also continued to include its dividend with distributable earnings in 2Q-22, indicating that the trust’s small business has a superior margin of safety. BXMT must be procured principally for its 8% passive income.