China’s currency hits highest level since March as stocks surge

China’s currency rose to its strongest level since March as a booming stock market and accelerating economic recovery galvanised investors.

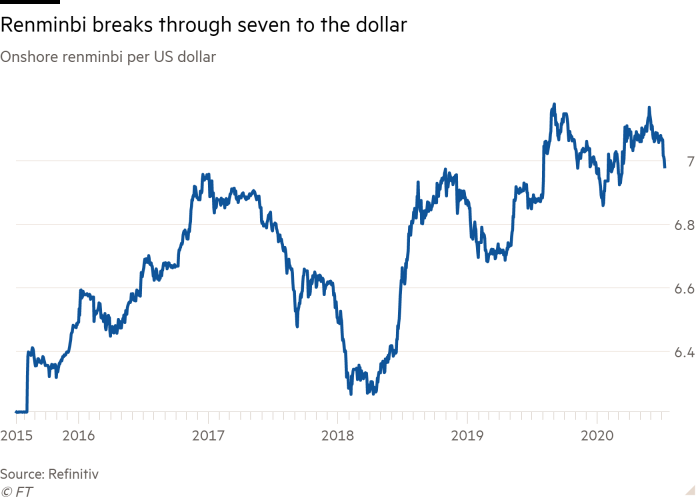

The renminbi, which has strengthened steadily since late May, on Thursday broke through the seven to the dollar level for the first time in four months, when efforts to contain the coronavirus outbreak squeezed economic activity.

Its ascent comes alongside a dramatic rally in Chinese equities that has at times been cheered on by the country’s state-run media. The CSI 300, which tracks the country’s biggest stocks listed in Shanghai and Shenzhen, has risen 10 per cent this week.

The rise past seven per dollar caps a significant turnround for the renminbi, which became a focal point in the long-simmering trade war between the US and China last year.

Chinese authorities had defended the renminbi weakening beyond seven until last summer, when the People’s Bank — which sets a midpoint around which the renminbi can trade 2 per cent in either direction against the dollar — let the rate sink to levels last seen in the global financial crisis.

That move through a key threshold, which was seen by the US as giving a leg-up to Chinese exporters, prompted the Trump administration to accuse Beijing of manipulating its currency. A few months later it dropped that designation, in a gesture designed to ease tensions ahead of a “phase one” deal on trade.

The onshore-traded renminbi rose 0.2 per cent on Thursday to 6.9899 per dollar. The offshore-traded currency, which can move more freely, hit 6.9902 per greenback after it also rose 0.2 per cent.

“We’ve seen China performing better on the way out of the coronavirus . . . ahead of many western economies,” said Rodrigo Catril, senior currency strategist at National Australia Bank. “There appears to be a motivation from China to demonstrate to the world that they are doing well.”

While China’s economy shrunk for the first time in more than four decades in the January to March period, recent signs of recovery have enthused investors. Profits at industrial enterprises in the country rose by 6 per cent in May compared with a year earlier.

“You have a clearly recovering economy,” said Dmitriy Vlasov, portfolio manager at East Capital. “You have seen strong sentiment, you have seen quite strong inflows through the Connect programme,” he added, referring to a platform that gives investors access to China’s retail-dominated stock market via Hong Kong.

State media promoted a “healthy” bull market on Monday, but its tone turned more cautious later in the week as stocks rallied further.

Alongside a pulsating stock market, analysts believe China’s currency has also benefited from the relative weakness of big western economies, some of which are still battling waves of the virus. The dollar has this week fallen against other currencies, including the pound and the euro.

Moh Siong Sim, currency strategist at Bank of Singapore, pointed to the prospect of a Joe Biden presidency following US elections in November as another possible reason for the renminbi’s strength. Investors believe Mr Biden is less likely to apply further tariffs to Chinese goods.

While China’s economy has shown signs of recovery, its export sector remains exposed to lower demand from other countries where the virus continues to rage.

Because of this, NAB’s Mr Catril suggested, the competitiveness of Chinese goods was less sensitive to currency fluctuations. “On a temporary basis you can afford to have a strong currency,” he said.