Coffee climbs as locked-down consumers seek caffeine fix

The coronavirus pandemic set off a scramble for coffee beans last month as roasters worked flat out to meet demand from stockpiling consumers while shutdowns disrupted supply.

José Marcos Magalhães, head of Brazil’s second-largest coffee co-operative Minasul, watched shipments to Europe and North America surge. Minasul had been expecting to ship 400,000 bags (each containing 60kg of beans) for the whole of 2020, but its orders rose past that level in March. Mr Magalhães now expects international sales for the year to top 800,000 bags — more than double last year’s 360,000.

“We are having very high demand, mainly from Europe . . . consumption has increased a lot in supermarkets in the USA, and they want to replenish stocks,” he said.

Having fallen at the start of the crisis as China’s cafés shut their doors, coffee prices have rebounded as large coffee roasters such as Nestlé, JAB and Lavazza rushed to secure beans. The futures benchmark for the higher quality arabica bean traded in New York has risen 20 per cent since the start of February to $1.20 a pound, making it one of the world’s top-performing commodities. Over the same timeframe, oil is down by more than 40 per cent, while copper has dropped about 8 per cent.

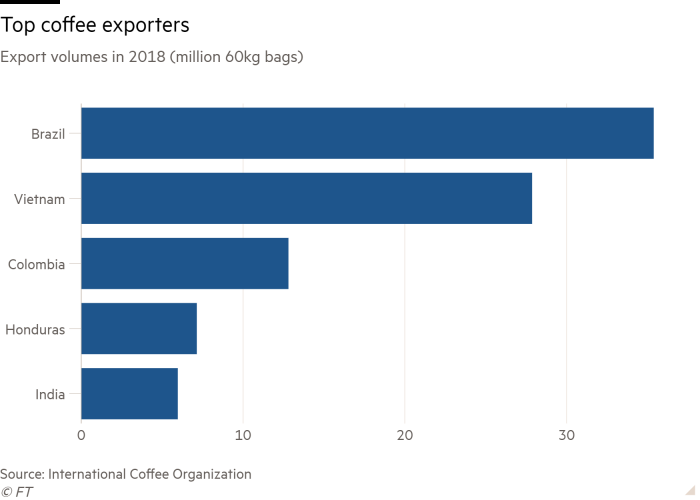

So far this month, prices have moved sideways, but supply risks are coming into focus, as inventories shrink ahead of the harvests in key arabica-producing countries in Latin America. Persistently low prices in 2018 and 2019 saw many growers abandon their farms, while exports from countries including Honduras and Colombia fell because of lower yields.

Certified arabica stocks at the ICE exchange, the market of last resort for buyers of physical beans, have fallen 11 per cent since the start of February to a two-year low.

“There is a shortage of washed arabica coffee,” said Roberto Vélez, chief executive of the Colombian Coffee Growers Federation, referring to the premium-grade beans processed for a milder cleaner taste.

Analysts at Rabobank expect the sluggish pace of exports from many countries to continue throughout 2020.

Even in Brazil, the world’s largest producer and exporter, some buyers have not been able to source as much as they want. “The stock is low and we were unable to fulfil all requests. As a result I am having to nitpick orders, but that is because I don’t have enough coffee,” said Mr Magalhães.

Producers’ hopes rest with Brazil’s harvest, which starts in May, and Colombia’s second harvest, its “mitaca”, which starts later this month.

Analysts expect prices to be volatile as traders try to second-guess whether Brazil’s crop, which is forecast to be near record highs, can be picked, processed and transported. With many workers in the country unwilling to travel far, there could be a shortage of migrant labour, according to Carlos Mera, analyst at Rabobank.

“What will happen to the harvest is a big question mark,” he said, noting that the peak of the pandemic is estimated to hit the country in late April to early May.

In Colombia, travel restrictions imposed by the national and local authorities pose a challenge to coffee picking, said Mr Vélez. Even if the cherries are picked, he added, there will be logistical challenges at every stage from farm to port.

There is also uncertainty over consumption. Consumer demand for packaged coffee jumped in March, with US weekly sales up as much as 73 per cent from the previous year, according to consumer data firm Nielsen.

But commodity brokers Marex Spectron expect overall demand to decrease as at-home drinking fails to compensate for a lack of consumption in chains such as Starbucks and in restaurants. Rabobank has pencilled in a demand fall of 0.4 per cent in 2020, compared with a 2.5 per cent increase in 2019. Such a drop would be similar to levels seen after the 2008 financial crisis.

The industry is taking heart from reopenings of cafés in areas first hit by the virus. Stephen Hurst, head of Mercanta, which specialises in supplying high-grade coffee to artisanal roasters and coffee shops, said he had seen his Asian business rebound. Although sales in Europe and the US dried up, activity in the Singapore office was “pretty much back to normal”, he said.

“[Asian countries] are at a different stage of the crisis and are coming out of the other side of it,” he said.

Back in Brazil, Mr Magalhães is hopeful that continued demand will keep prices at current levels, and that Minasul can overcome logistical challenges. There are reasons to be cheerful. Roads and ports have remained open while shipping giants such as Maersk are trying to resolve the scarcity of containers for exporters.

Moreover, the bulk of the co-operative’s 8,000 growers on smallholder farms are already in a “natural quarantine”, Mr Magalhães said. “They live on the farm, isolated, which is another thing that would allow coffee agriculture to continue running.”