Danone dips into sour debt markets with new deal

French yoghurt producer Danone breathed fresh life into an ailing global debt market on Wednesday, taking advantage of a period of relatively favourable conditions to issue the first European corporate bond of the week.

The company issued an €800m seven-year bond, attracting €5.8bn in orders, suggesting appetite for new deals can still be found after a broad decline in risky assets triggered by fears over the spread of coronavirus and a sharp drop in the oil price.

Danone is “the kind of name you’d expect to reopen the market”, said Souhail Mahjour, a managing director at HSBC, one of the banks running the deal.

The company has an investment-grade rating from rating agencies S&P and Moody’s, and is in a classically defensive sector. In times of market volatility, investors tend to huddle in industries such as utilities and consumer staples, which are seen to provide reliable returns.

Turbulence in global markets has forced many companies to shelve their fundraising plans in recent weeks. But Danone’s deal shows that some transactions can still find support from investors.

The Bank of England’s decision to cut interest rates on Wednesday, coupled with a call from European Central Bank president Christine Lagarde for stimulus measures the day before, were both “extremely helpful” in creating welcoming conditions for Danone, said Mr Mahjour.

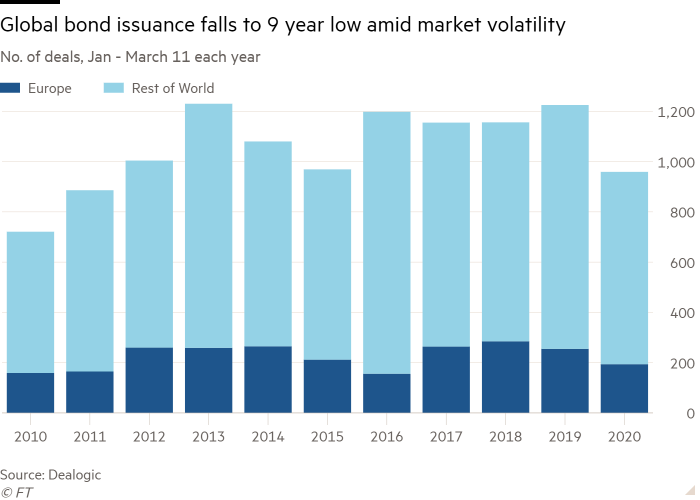

The syndicate desks of international banks in New York, Europe and Hong Kong have been calm over the past month. In the last week of February, there was one corporate bond issued in the US and six in Europe, according to data from Dealogic — an unusually quiet spell outside of the year-end and summer lulls. Globally, just $5.5bn of debt has been sold this week, one-ninth of the prior week’s total.

In equity markets, too, listings have dropped off from a peak of almost $5bn in the first week of February, to $900m in the final week of the month.

“Well-rated and well-known names from the first row of companies have an advantage,” said Armin Peter, global head of the debt syndicate at UBS.

Deal volumes picked up a little last week, with paint company Sherwin-Williams announcing its first investment-grade bond sale in the US. A flurry of debt deals in Europe included a €1bn bond for US industrial company Honeywell.

A backlog of deals has built up in “very challenging market conditions,” said Mr Mahjour. Opportunities to launch deals in benign conditions have “been rare and sometimes non-existent”, he added.