Don’t trust the stock-market bounce until S&P 500 is back above 3,800: analysts

U.S. stocks keep on being in bounce mode just after the S&P 500 index tumbled final 7 days to its lowest complete since December 2020, but lots of chart watchers keep on being unconvinced the uptick will confirm to be anything at all a lot more than a different bear-market place rebound.

What would it acquire to alter their minds? The 3,800 level on the index, which has so considerably demonstrated to be stiff resistance, is in emphasis.

“Since the starting of previous 7 days, 3,800 has become a new ceiling for the S&P 500 as sellers have repeatedly stepped in and overwhelmed the tentative, weakhanded bids,” explained Tom Essaye, founder of Sevens Report Investigation, in a Thursday notice.

The S&P 500

SPX,

was up .1% at 3,763 in choppy trade Thursday afternoon, and on monitor for a 2.4% weekly obtain. The Dow Jones Industrial Common

DJIA,

was down around 90 points, or .3%, on monitor for a 1.7% weekly advance.

The selling price action about 3,800 is in holding with the massive-cap benchmark’s bear-current market slide this yr, Essaye observed.

In early February, the S&P 500 repeatedly tested the 4,600 amount before a 10% peak-to-trough drop to its late-February lower, he recalled. Then just after a March bounce, 4,500 served as a ceiling, with the market’s early April failure placing the stage for one more 10% drop, Essaye mentioned. In late April, 4,300 became the new resistance, with the market failing to overcome it many moments just before falling additional than 11% into the latter fifty percent of May perhaps. In early June, 4,150 became resistance, with failure to triumph over leading to a 13% peak-to-trough drop.

“Now, regardless of whether the sector is poised to drop one more 10% from this new resistance level (which would be down in the direction of the 3,400 space) stays to be observed and a squeezy leg better is even now a incredibly good likelihood,” Essaye explained. “But bottom line, marketplaces have a pattern of repeating them selves, and so much this year, the S&P 500 has failed at ’round numbers’ likely due to the influence of derivatives traders, a minimal of four periods.”

That leaves 3,800 as critical close to-time period tipping issue to view, he stated, as a split above could induce a “potentially violent” squeeze greater, “while one more failure would indicate new lows are all but specific,” Essaye stated.

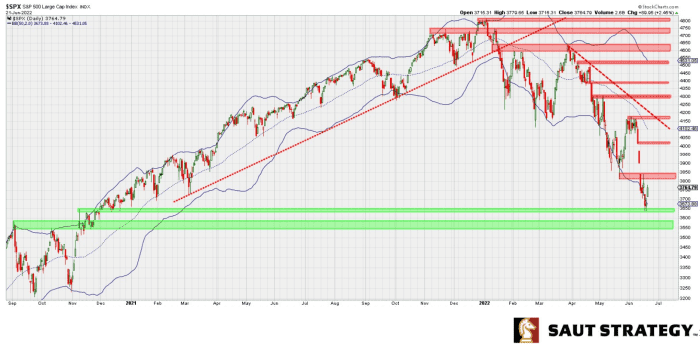

Technological analyst Andrew Adams, in a Wednesday be aware for Saut Method, explained the industry as having “baby techniques to try to come across a bottom in this article,” but noted a close above the 3,800 amount would deliver some comfort.

Pointing to the chart beneath, Adams explained there was complex justification for the S&P 500 bouncing where it did on Friday, delivering at the very least some preliminary indications that a possible lower was struck. Adhere to-by means of to the upside is vital in the times ahead, he wrote, with the very first hurdle at 3,800 and a take a look at of the “gap” on the chart amongst 3,838 and 3,900.

Saut Strategy

The technician famous “open space” in between 3,800 and roughly 4,100 on the chart thanks to the market’s speedy drop more than the past several months, arguing that if the S&P 500 can sustain a move earlier mentioned 3,800 it’s possible that a “price vacuum” could pull the index bigger. The environment, having said that, remains “high risk” below 3,800.

“I’ll come to feel a tiny better about having chances on the very long side if the S&P can crack higher than 3800 and maintain previously mentioned it,” Adams wrote. “If that occurs, I think the more aggressive participants can start off adding again on some possibility in hopes of a probable low getting struck. Until finally then, we have to make this market confirm by itself.”