ECB set to expand bond-buying to soak up debt

When the European Central Bank reveals its next step on Thursday, its president Christine Lagarde is widely expected to announce a fresh boost to its stimulus efforts to tackle the economic and financial fallout from the coronavirus pandemic.

Most economists are convinced the ECB will expand its €750bn Pandemic Emergency Purchase Programme (PEPP) — the extra bond-buying scheme it launched in March. Having already spent more than €210bn, the programme is on track to run out of firepower by October.

“It’s become clear that the €750bn PEPP will not be enough,” said Erik Nielsen, chief economist at UniCredit.

Several ECB governing council members have already signalled that they expect to expand the scheme this week. François Villeroy de Galhau, governor of the Banque de France, recently said: “We will very probably need to go even further.” Ms Lagarde herself said: “We will not hesitate to adjust the size, duration and composition of the PEPP to the extent necessary.”

Some investors worry that the ECB’s capacity for monetary easing could be complicated by the German constitutional court’s recent explosive ruling against the ECB’s older sovereign bond-buying programme. Yet Ms Lagarde has insisted it will be “undeterred”.

One way to show this would be for the ECB to not only expand the PEPP scheme but also to commit to reinvesting proceeds from the scheme for several years to come. The central bank could also extend the life of the scheme into next year and broaden it to buy a wider array of assets, including “fallen angel” bonds of companies that have recently been downgraded to junk status.

All this would help the ECB keep pace with the downturn in the eurozone economy.

As many of the lockdown measures introduced in March to contain the pandemic are eased, business surveys and real-time indicators such as electricity usage, traffic volumes and travel levels have started to recover.

However, economic activity remains well below pre-pandemic levels and most economists expect a sharp downturn followed by a recovery over two to three years, rather than a swift rebound.

The ECB is due to update its own forecasts on Thursday and Ms Lagarde signalled their likely downward direction last week by saying she expected the eurozone economy to shrink between 8 and 12 per cent this year — the most since before the single currency bloc was created two decades ago.

Isabel Schnabel, an ECB executive board member, told the Financial Times last week that its medium-term inflation outlook would be “of particular interest” and the central bank stood ready to “expand any of its tools” if the situation “deteriorated”.

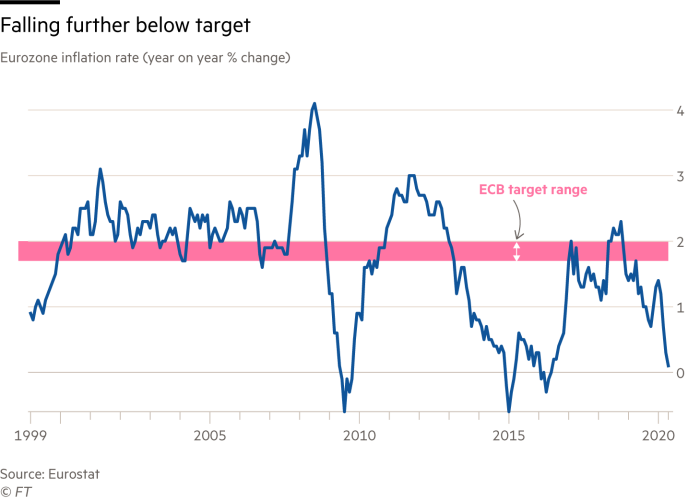

Price growth in the eurozone slid to 0.1 per cent year on year in May, due to a sharp drop in energy prices. That took the ECB further away from its core inflation target of below but close to 2 per cent, making it more likely that the central bank will cut its March forecast for price growth to reach 1.6 per cent by 2022.

The effect of coronavirus lockdowns on inflation is a hot topic among economists, as it could act in either direction. A drop-off in consumer demand would serve to keep prices low, but business closures and disruption to trade could limit supply, putting upward pressure on prices.

“Underlying inflation projections are likely to be revised down since the demand shock will put downward pressure on prices, at least in the short term, more than offsetting any supply-side effect from Covid-19,” said Frederik Ducrozet, strategist at Pictet Wealth Management.

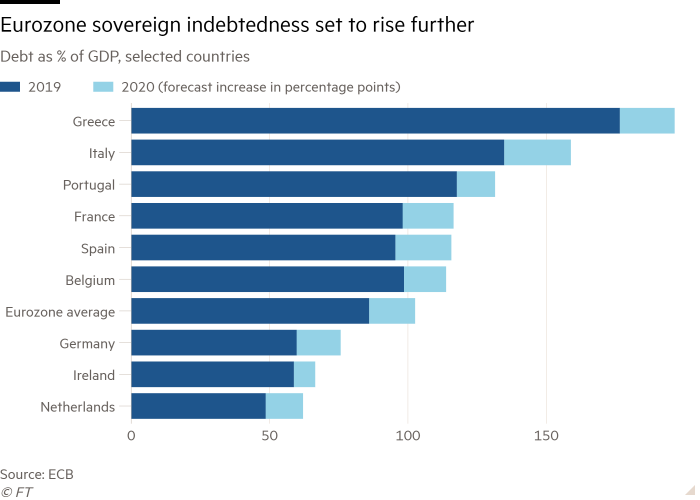

To tackle the economic malaise, the ECB expects eurozone governments to raise their debt issuance by €1tn to €1.5tn this year, running an average budget deficit of 8 per cent. On top of that, the EU plans to borrow €750bn through its new recovery fund.

Those figures could increase further if the economic recovery is sluggish, offering another reason why the ECB might want to increase the scale of its bond buying, analysts said.

“We estimate that the ECB is currently buying roughly the same amount as the projected deficits for many European countries, but we think that many of these deficits could actually be much larger, which could require the ECB to upsize its current purchases,” said Praveen Korapaty, chief interest rates strategist at Goldman Sachs.

But even if it increases the PEPP, the ECB is expected to reiterate its longstanding message that it cannot deliver an economic recovery on its own.

Although Ms Lagarde is expected to hail the EU recovery fund as an important step to share the burden of tackling the pandemic, she has repeatedly urged European governments to inject more fiscal stimulus into the region’s faltering economy.

The new recovery fund only marginally eases the pressure on the ECB to continue to act as the main backstop preventing the eurozone from sliding into another financial crisis, analysts said.

“The recovery fund of course will help — but it only really kicks off in 2021 and the impact is unlikely to be immediate as it will unfold over the course of the coming years,” said Katharina Utermöhl, economist at Allianz. “The ECB is still very much on the hook.”