Enforcing competition would ease food price hikes in east and southern Africa

[ad_1]

Compact and medium-scale farmers and agri-organizations in east and southern Africa are getting a uncooked deal. To thrive they want fair and built-in regional marketplaces. Analysis by the Centre for Levels of competition, Regulation and Financial Improvement has highlighted the need to have for much better integration of regional economies as a action towards meals security in the area.

Potent industrial pursuits, significant transport costs and inadequate obtain to amenities these types of as for storage mean that compact and medium-scale farmers are often not having honest rates for the foods they increase. Good selling prices are all those that satisfy desire and include realistic expenses of source together with transportation throughout borders.

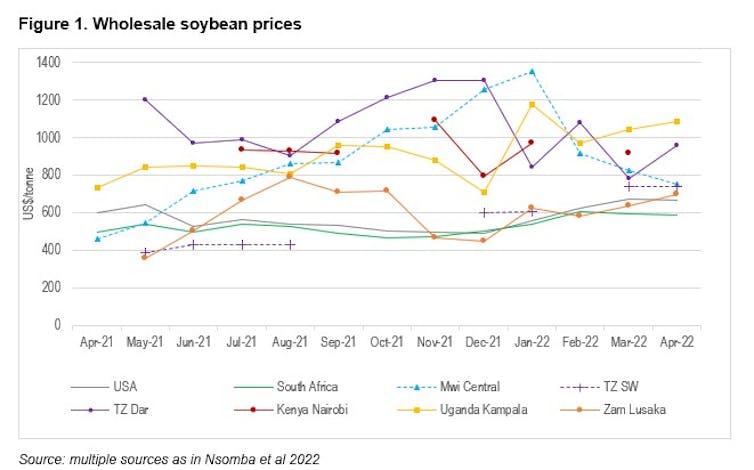

All through the study course of our study we arrived throughout illustrations of how the odds are stacked against most tiny and medium-scale farmers. Consider the experience of Endrina Maxwell, a compact producer in Malawi. In April 2021, she bought her soybean crop in central Malawi and realised the returns from investing in professional agriculture as a female agribusiness proprietor and farmer. She obtained selling prices about Malawi kwacha 350/kg, about $450/t (see Determine 1). At the exact time, the selling prices in the main marketplaces in Dar es Salaam and Nairobi ended up more than a $1000/t.

A number of hurdles stood in Endrina’s way to just take advantage of the significant charges in neighbouring nations around the world. First, unique selling price information and facts was not easily out there for anyone in Endrina’s posture to be conscious of the gains from exporting. Next, transportation costs are really high for scaled-down producers. Third, to hold-off from promoting at the harvest and to bargain for far better gives, producers like Endrina require to have storage solutions.

This condition does advantage some. These involve the major traders and processors in Malawi and across the area. These companies purchased up a great deal of the crop at the time of harvest at small costs, for regional use and for export, getting advantage of their storage facilities and personal facts. Price ranges in Malawi then amplified to peak at $1350/t in January 2022, as if there was a critical scarcity.

The trebling of soybean rates affected an additional cohort of modest-scale farmers. Soybeans are a essential element of poultry feed. Smaller-scale poultry farmers noticed their animal feed price ranges improve by equivalent amounts, squeezing them severely.

Our analysis identifies a lack of efficient regional competitiveness and suggests the want to inquire into transportation, storage and logistics issues. The variances in selling prices in between places on transportation corridors translate into rents to transporters and arbitrage margins remaining produced by significant traders. It also details to supplies remaining purchased-up by intermediaries at minimal prices at the harvest and held again to push price ranges up.

The fragile foodstuff techniques in the region, mixed with expanding focus at a number of ranges of key value chains, calls for a regional levels of competition policy for resilient and sustainable regional price chains.

A stronger regional sector referee to monitor and enforce competitors guidelines would degree the participating in subject for fairer food stuff markets.

The Prevalent Marketplace for Eastern and Southern Africa Level of competition Commission functioning jointly with nationwide competitiveness authorities, has the central role to perform.

What’s lacking

The African Industry Observatory was created to fill the gap of reputable market place details for key food items goods at the wholesale and producer concentrations. The observatory tracks and compiles rates month-to-month. The to start with 12 months of details gathering by the observatory underlined the advantages to lesser sector participants of sector knowledge.

This 12 months, with the African Industry Observatory, it has been doable to track marketplaces by way of crowd-sourcing costs from lesser market place members. Access to this information has permitted Endrina to foresee what she should get for her soybean harvest. It has also enabled her to plan her other organization – oil output – additional efficiently.

The pricing designs have highlighted the critical function that entry to aggressive transport services as perfectly as storage facilities perform in accessing marketplaces and fairer price ranges. This has informed Endrina’s conclusion to spend in storage services on her farm as a final result of identifying that there is benefit in spreading her grain revenue in the course of the calendar year as opposed to selling only at the harvest.

To bolster the region’s fragile foods protection – manufactured worse by weather alter –it’s necessary that generate can be sourced from across the region, which is the most value productive way to satisfy the needs of prospects and to reward producers for increasing supply.

This is most apparent in Kenya exactly where foods charges have risen exponentially. The nation is going through the most serious drought in 40 years. In addition, the war in Ukraine is compounding intercontinental pricing pressures.

This usually means that Kenya wants to source imports from the location in which temperature has been good at good competitive price ranges. Yet, in spite of rising manufacturing in nations around the world this kind of as Malawi and Zambia, cross-border trade is not occurring correctly.

Unfair trade

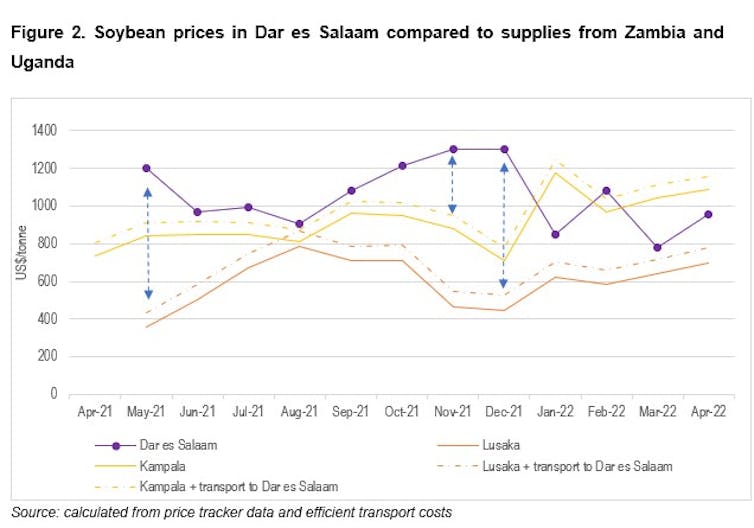

By contemplating the industry clearing resources of supply for the most important centres of desire in Dar es Salaam and Nairobi we can see that soybean prices have been way previously mentioned the truthful import prices. This indicates that producers received also minimal and conclusion end users paid way also significantly, with intermediaries capturing the distinction.

Dar es Salaam could have sourced soybeans from Malawi, Zambia or Uganda – all neighbouring nations around the world – to insert to domestic materials. Prices at over US$1200/t in some months, these as Oct to December 2021, were US$200-400/t higher than what it should have expense to land items from Uganda and US$400-750/t higher than what it should have expense to land from Zambia. This consists of an efficient transportation charge, calculated at US$.04/t/km from various sources.

Regional trade and aggressive markets are also impeded by governments. Zambia had an export restriction on soybeans from August to November 2021. Getting rid of the restriction brought lower rates to purchasers in Dar and larger prices to sellers in Zambia, benefiting both equally sides by means of trade.

Wherever the area is not able to just take advantage of superior provide in some destinations to satisfy demand from customers in others at competitive price ranges, this locations wonderful force on downstream industries. For illustration, animal feed producers in Kenya who are potential buyers have been hit really hard.

A bundle of interventions to make certain regional marketplaces do the job improved is urgently essential.

Building regional markets do the job

We propose the strengthening of a few priority locations:

- coverage and advocacy,

- enforcement, such as towards cartels and

- regional merger analysis.

Levels of competition advocacy and policy is necessary, as lots of of the things undermining powerful regional aggressive marketplaces consist of policy areas. Regulatory obstacles, for example, undermine trade and fortify the marketplace electrical power of providers in just international locations.

The Comesa Competition Commission and countrywide authorities in the area need to have to urgently act jointly in these areas to tackle badly doing work regional foods markets.

The African Current market Observatory is a starting off stage for information assortment the place analyses can be deepened, collaboration can be strengthened, and access to pricing facts improved for marketplace participants.![]()

Grace Nsomba, Researcher at Centre for Levels of competition, Regulation and Economic Advancement, College of Johannesburg and Simon Roberts, Professor of Economics and Lead Researcher, Centre for Competitiveness, Regulation and Economic Growth, UJ, University of Johannesburg

This post is republished from The Conversation under a Inventive Commons license. Go through the primary report.

[ad_2]

Source connection