How this fintech startup overcame COVID-19 challenges to see over 100 percent growth in 2020

The COVID-19 pandemic uncovered the pressure of the fiscal services sector where institutions have been cautious of offering credit history, while consumers sought a moratorium on payments. But this was not the situation for Bengaluru-centered fintech startup Slice, whose organization grew by 125 percent in 2020.

Established in 2016 by Rajan Bajaj, the startup provides electronic payment and monetary credit rating expert services focused on Generation Z and younger millennials.

According to Slice, compared with other startups, it located a ton of positives during the pandemic. In actuality, Slice saw its shoppers were being increasingly relying more on their credit history card for numerous variety of payments. Slice had introduced a actual physical card to its portfolio of goods in May 2019, and in Oct final year, it partnered with Visa to introduce a zero payment aspect credit score card for its customers.

Rajan Bajaj, Founder and CEO, Slice, says, “Prior to COVID-19, our clients had been mainly relying on us for ecommerce transactions. But now, 50 p.c of their month to month payments are occurring via the Slice card.”

With all over 3,00,000 prospects, Slice has its presence in around 30 metropolitan areas in the country as of now, and aims to increase it to 50 in the upcoming a person calendar year.

Challenges and advancement

According to Rajan, clients have now started out using the Slice card for making payments in categories this kind of as grocery buying, ordering meals, etc.

This has not been an uncomplicated feat for the startup as it had to experience certain troubles in the course of the lockdown period in 2020. From the time it introduced a physical card in 2019, it recorded month-on-month advancement of 25 per cent in phrases of purchaser additions, but all this virtually came to a halt in March 2020.

On the other hand, Slice restarted operations after the lockdown limitations were eased, and has at present provided close to 1,25,000 cards.

“We are back on monitor despite dropping the momentum for a couple months in 2020,” claims Rajan.

Through the original period of time of the lockdown very last calendar year, Slice was in a predicament as to how it would deal with the troubles posed by the pandemic. Queries have been lifted all over no matter whether it would be prudent for the company to lengthen credit score to its clients, primarily when there was information of job losses or on-boarding of new people.

“We did have our honest share of discussion and determined that our clients desired us far more than ever,” states Rajan.

Stringent range method

What proved to be the major USP for Slice to tide in excess of any probable delinquencies of credit history payments was its stringent onboarding procedure the place it onboarded only creditworthy customers. It also delivers its playing cards to the student group.

Slice has received competition from other fintech startups these types of as KrazyBee, Fampay and even from the classic banking companies which present credit score services.

Rajan states, “We have established the bar substantial to select our shoppers. Now, we have onboarded around 3,00,000 clients and 8,00,000 of them are on the waiting around record.”

The stringent variety course of action mainly focuses on the creditworthiness of any potential client.

Slice Founder & CEO Rajan Bajaj

There was also apprehension on whether or not expending would dramatically appear down through the pandemic. Nevertheless, the expending patterns amongst its consumers has now absent back again to pre-COVID degrees, and the startup is back on the substantial advancement keep track of.

“In the final pair of months, the greatest results for us was not the progress by itself, but the cohort of prospects who are investing extra through us. Observing this sort of adoption is really reassuring,” says Rajan.

The CEO of Slice strongly believes that the expertise it gives to any future consumer is also its powerful stage. These incorporate the entire onboarding procedure, the ability to do most of the issues on the app, solving for just about every trouble by the electronic funnel, product or service-marketplace-in shape, etc.

According to Rajan, Slice enjoys a net promoter score of over 70, which signifies consumer fulfillment. “Seventy 5 percent of our prospects occur as a result of reference and this is taking place at scale,” he remarks.

The regular age of buyers at Slice is all over 22-23 decades, and around 60 percent of them are utilized. It also has potent traction with the pupil neighborhood wherever it offers to reduced credit rating restrict with an purpose that it would grow along with them the moment they are utilized.

“We give the students an option to make their credit score record, which would be pretty helpful in the long term,” states Rajan.

Aiming bigger

At current, Slice is registering an annualised gross transaction quantity (GTV) of all over Rs 1,600 crore ($222 million) about. Rajan says, “We have developed by 100 p.c from where we were being pre-COVID.” The startup aims to touch $500 million GVT in 2021.

Rajan states, “The target is on scaling wherever we are looking at a million customers in future 12-15 months and purpose at increased NPS rating.”

In direction of this aim, Slice ideas to undertake a couple of strategic initiatives. It strategies to introduce UPI payment possibility on its platform, boost emphasis on rewards and offers for clients, suitable partnerships for its form of purchaser base, investment and saving features on its app, and so on.

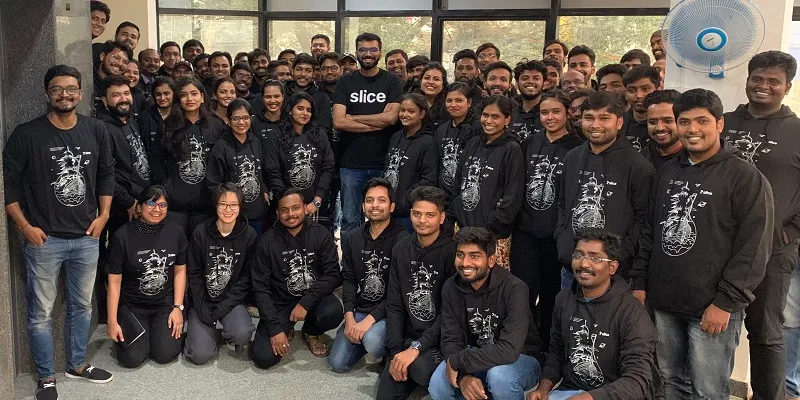

Slice team

To preserve pace with the client progress, Slice is actively increasing its team and options to double its workforce in 2021, with a key concentrate on engineering and solution groups.

The startup also has its individual NBFC licence, which presents credit history to customers aside from possessing a partnership with other fiscal establishments for boosting financial debt. Rajan states Slice is now looking to increase dollars from cash marketplaces for the duration of the later on component of the year.

Slice is backed by VCs this kind of as Gunosy Money, Das Funds, Finup, Blume Ventures India, Simile Venture Husband or wife, EMVC, Tracxn Labs, Better Cash, Sachin Bansal’s Navi, together with angel traders such as Kunal Shah. It has elevated $33 million until now.

“For us, the greatest accomplishment was not just advancement, but the cohort of our shoppers,” says Rajan.