Investor appetite returns for junk bonds

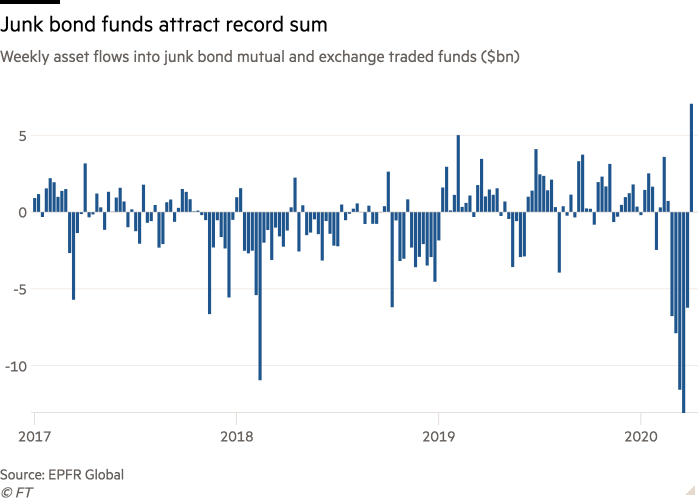

Junk bond funds attracted record inflows in the week ending Wednesday as investors begin to show renewed appetite for riskier corners of the credit market.

Mutual funds and exchange traded funds that invest in junk bonds had $7bn in inflows, the biggest-ever weekly sum, ending a five-week run of outflows. The inflows were led by a record $5.9bn flowing into funds that invest in US junk bonds, according to EPFR Global data.

The inflows come after a wave of global central bank and government stimulus, strong appetite for new deals and the rising price of oil, which helps the energy companies that make up a big chunk of the junk bond market.

“There is hunger for high-yield,” said Quincy Krosby, chief market strategist for Prudential Financial. The inflows show that investors believe the Federal Reserve’s plan to buy billions of dollars in investment grade credit will have an impact on the junk bond market. “You can see the effect of the Fed’s action on the investment grade market. There is a hope that the high-yield market moves in the same direction,” Ms Crosby said.

Yum Brands, which owns the fast food outlets KFC, Taco Bell and Pizza Hut, who are all facing a hit from the slowdown, ended a dry patch of junk bond deals this week with an offering that was several times subscribed. The strong demand prompted the company to increase the size of the offering by $100m to $600m.

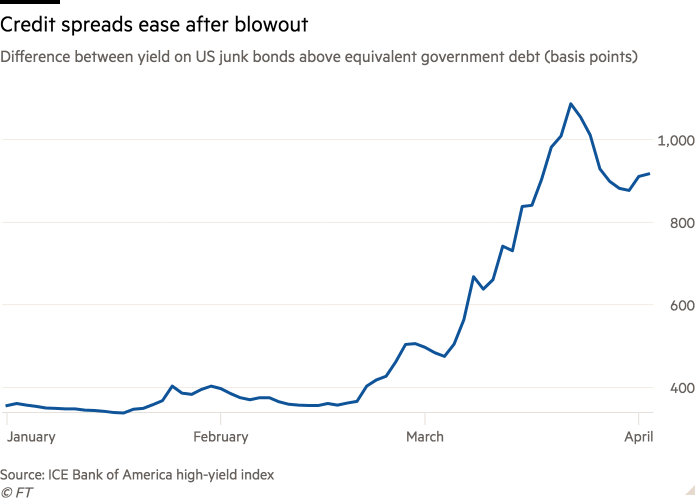

The inflows come as the yield junk debt commands above equivalent US government bonds, known as the credit spread, eased to 911 percentage points on Wednesday, down from a high point for the year of 1,087pp hit late in March, according to the ICE Bank of America High Yield bond index.

The junk bond inflows show investors are “dipping their toes back in the water,” said Kevin Lorenz, a portfolio manager at Nuveen Asset Management, which runs a high-yield bond fund that has lost 19 per cent this year, according to Morningstar, largely due to its energy holdings.

“An awful lot of the bad news is priced into the market but we would not want to wager that we have hit the lows,” Mr Lorenz said.

Money market funds attracted $194bn for the week, down from a record high the week before, while US equity funds had $4.8bn in inflows, partially reversing the $15.8bn in outflows over the previous week.

Additional reporting by Colby Smith in New York