‘Large demand gap’ looms for US government bonds

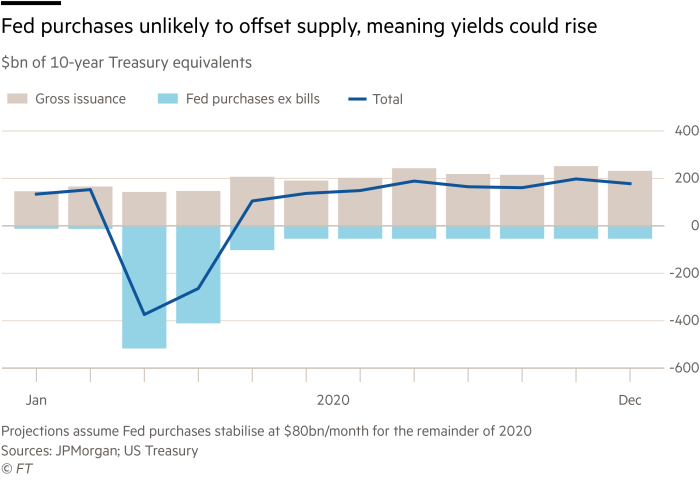

A gulf is growing between the amount of US government debt to be issued by the Treasury department this year and what the Federal Reserve is planning to buy.

The US fiscal deficit is on track to reach levels not seen since the second world war and the Treasury department is preparing to issue a record amount of securities to fund it, meaning that issuance could exceed $4.7tn this year. An increasing proportion of that borrowing will come from longer-term debt.

Meanwhile, the Fed has sharply scaled back the pace of its asset purchases, from $75bn a day at the height of the pandemic in March to roughly $80bn a month since early June. At this rate, the central bank will snap up just a quarter of the gross long-term Treasury supply in the second half of the year, JPMorgan calculates.

That left a “large demand gap”, the bank said, especially if private investors do not ramp up their purchases. However, fears that this gap could cause yields to spiral higher, potentially upsetting still-fragile financial markets, may be unfounded.

The analysts at JPMorgan do expect yields to climb but think the rise will be “modest,” as investors will continue to demand safe assets during the contraction in economic activity and growing deflationary risks.

Treasury yields have hovered at record lows since the coronavirus outbreak ripped through global markets three months ago. Inflation expectations have fallen dramatically in the months that followed, with one market measure derived from inflation-protected US government securities — the 10-year break-even rate — remaining at just over 1 per cent.

Given that this is some way short of the Fed’s 2 per cent target, few investors see the central bank tightening its monetary policy by raising rates or scrapping asset purchases any time soon.

“Unless inflation expectations rise rapidly and the market prices an aggressive tightening path for the Fed, long-term yields are unlikely to rise significantly, despite deficits larger than we have seen in over 80 years,” said the JPMorgan analysts.