Latest Data Shows Trend Toward Economic Recovery, but Black Workers and Businesses are Being Left Behind

With financial action beginning to rebound throughout the commonwealth and the country in Could and June, the most recent data exhibit some advancements in work. On the other hand, the problem is not bettering for Black employees and business house owners. Extensive-standing limitations to economic prospect, a higher probability of functioning or possessing a enterprise in the industries most afflicted by the COVID-19 pandemic, and problems to doing work from house have intended that the financial effects of COVID-19 is slipping even heavier on Black employees and business enterprise entrepreneurs. These similar communities also deal with larger issues in accessing aid. As Virginia continues to navigate the quite a few impacts of the COVID-19 pandemic, it is essential that lawmakers prioritize the wants of Black workers and companies, who confront the greatest boundaries and have been hardest strike by the latest downturn.

Unequal Access to Money, Wealth, and Health-Associated Positive aspects Location Black Households at Greater Risk

At the outset of the COVID-19 pandemic, unemployment in Virginia improved overall. But Black Virginians have extensive confronted limitations to economic opportunity due to systemic exclusionary guidelines these as housing and work discrimination, ensuing in greater unemployment, decreased cash flow, and significantly significantly less prosperity than their white counterparts all over background. In 2018, for occasion, median house revenue for white homes was 70% bigger than for Black households. And Black households are far more than twice as possible to be in poverty than white households who hold, on average, additional than 5 periods as a lot liquid property as Black people do. Black workers are also ordinarily compensated decrease wages — 73 cents, on normal, for each dollar paid out to a white worker. This has placed Black households in a far more precarious position for working with the financial consequences of the pandemic.

Even just before the pandemic, in the initial quarter of 2020, unemployment for non-Hispanic Black men and women in Virginia was by now 1.1 percentage points greater than the unemployment charge for the relaxation of the population (3.7% when compared to 2.6%). In the second quarter of 2020, the unemployment charge greater to 9.4% for the non-Black populace, but rose to 11.1% for individuals who determined as non-Hispanic Black. [Note: this analysis is based on IPUMS Current Population Survey (CPS) microdata, which produces slightly different numbers for some months than state employment statistics published by the Bureau of Labor Statistics that also incorporate other data sources; however, the CPS microdata are the only timely and publicly-available source for sub-national employment data by race and ethnicity.]

There are also sizeable distinctions in entry to added benefits this sort of as health insurance, compensated ill depart, and the potential to perform from dwelling. Just 58.7% of Black employees report that they have entry to compensated sick times, in comparison to 66.6% of white workers, and only 19.7% of Black personnel, in comparison to 29.9% of white personnel, report that they could do the job from property. The capacity to keep property without having panic of financial ramifications has develop into even a lot more important through the COVID-19 pandemic, when touring to get the job done can imply placing one’s health and protection in hazard.

The mixture of these factors has resulted in the pandemic acquiring a specifically devastating affect on Black households, who do not delight in the financial buffer that enables white households to superior cope with the economic hardships introduced about by COVID-19.

COVID-19 Ever more Exacerbating Pre-Current Inequalities

As the pandemic drags on, Black employees proceed to be at higher chance of remaining out of a task. Following a 22.2 million drop in employment over March and April put together, overall nonfarm U.S. employment rose by 2.7 million in May well and one more 4.8 million in June. But Black personnel are not experiencing the positive outcomes of this economic restoration to the identical diploma. When the nationwide unemployment charge fell from May possibly to June for all demographic groups, Black unemployment continues to be particularly higher at 15.4%, in contrast to 10.1% for white personnel and 11.1% for all workers.

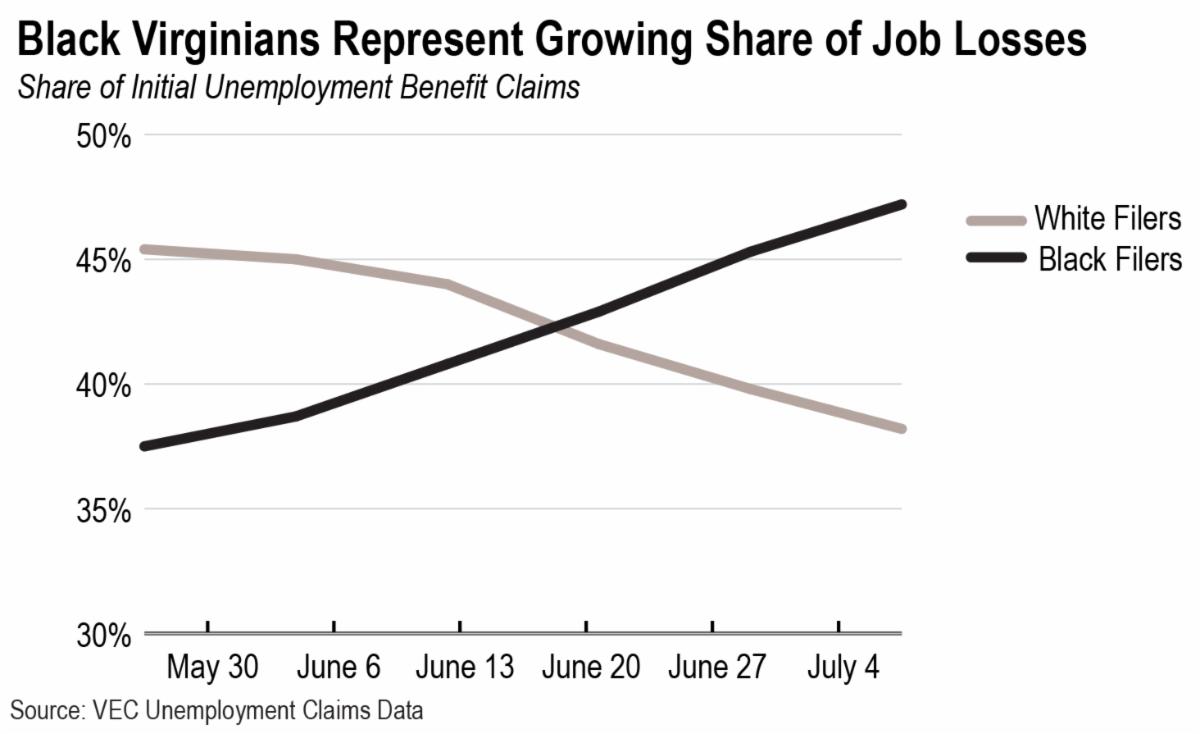

There is a related pattern in Virginia, with task losses slowing for white Virginians while growing for Black Virginians. In mid-May, 30% of Virginia personnel who were obtaining unemployment insurance policies ended up Black, which is considerably increased than the share of all staff in Virginia who are Black (19%). Total jobless claims improved from April to May, and the share of those promises manufactured by Black Virginians also elevated, indicating that Black workers may be enduring a expanding share of new occupation losses. From late May to early July, weekly unemployment coverage initial claims in Virginia remained reasonably steady total, but fell by 15% for white filers and rose by 28% for Black filers. Not only did the quantity of Black filers raise, but the share of original filers who recognized as Black improved from 37.5% to 47.2% around that time period of time. This suggests that the pandemic carries on to bring about financial devastation for Black Virginians, even as disorders surface to be improving upon for white Virginians.

In addition to our country’s prolonged history of obstructing the improvement of Black folks as a result of exclusionary policies, special difficulties dealing with Black communities may possibly aid to describe the unbalanced outcomes of the pandemic. Black employees accounted for 12.3% of the countrywide labor drive in 2019, but designed up a higher share of personnel in the retail trade, leisure and hospitality, and instruction and well being solutions — three sectors that have been significantly impacted by COVID-19, accounting for just over 50 % of the work opportunities missing in April.

Black personnel are also much less most likely to be capable to carry on working from the security of their houses owing to technological limitations — the share of Black households with a computer system in the residence is 5% decreased than for white homes, and the share with a broadband online membership is 10% lessen. Further, complications in accessing help make it much more difficult for Black households to get well from the financial downturn. Approximately 17% of Black households did not have a bank account in 2017, as opposed to just 3% of white homes, which very likely delays assistance, these types of as the CARES Act economic impact payment, for Black households.

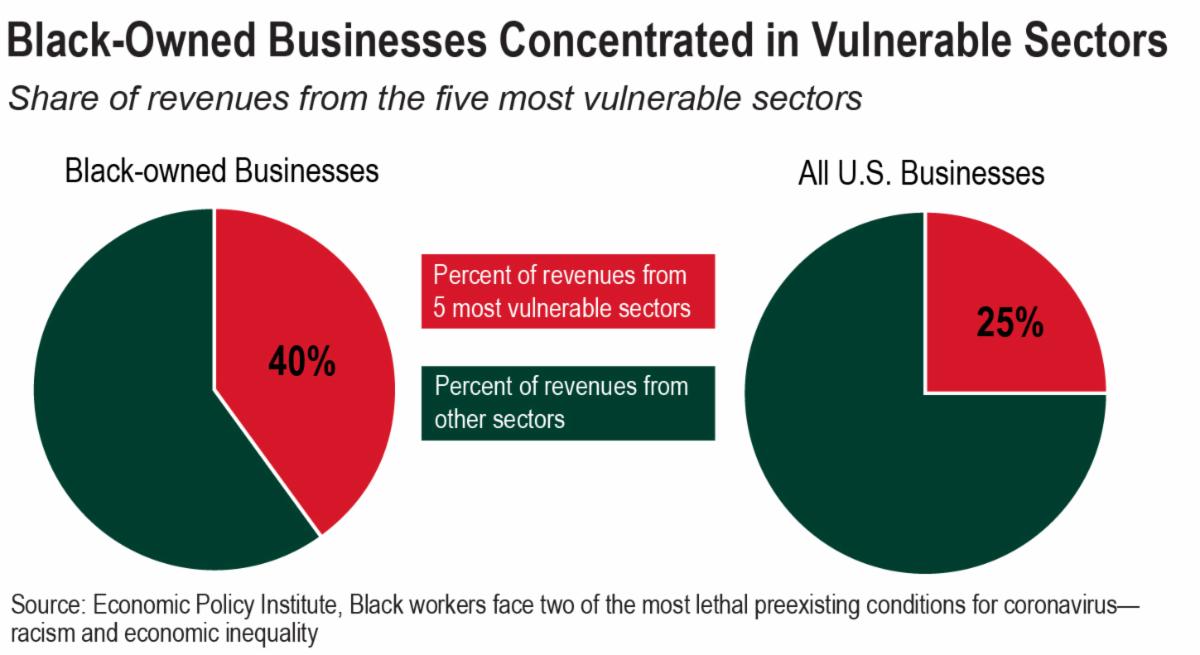

The unbalanced economic consequences of COVID-19 lengthen to Black-owned firms as effectively. Black-owned firms are extremely concentrated in the industries with the most significant job losses from the pandemic. The 5 most susceptible sectors — which include leisure, hospitality, and retail — make up 25% of the revenues of all U.S. organizations, but 40% of the revenues of Black-owned companies. While the amount of energetic company owners in the U.S. dropped by 22% from February to April, the amount of Black small business entrepreneurs dropped by 41% — more than double the proportion of white company losses.

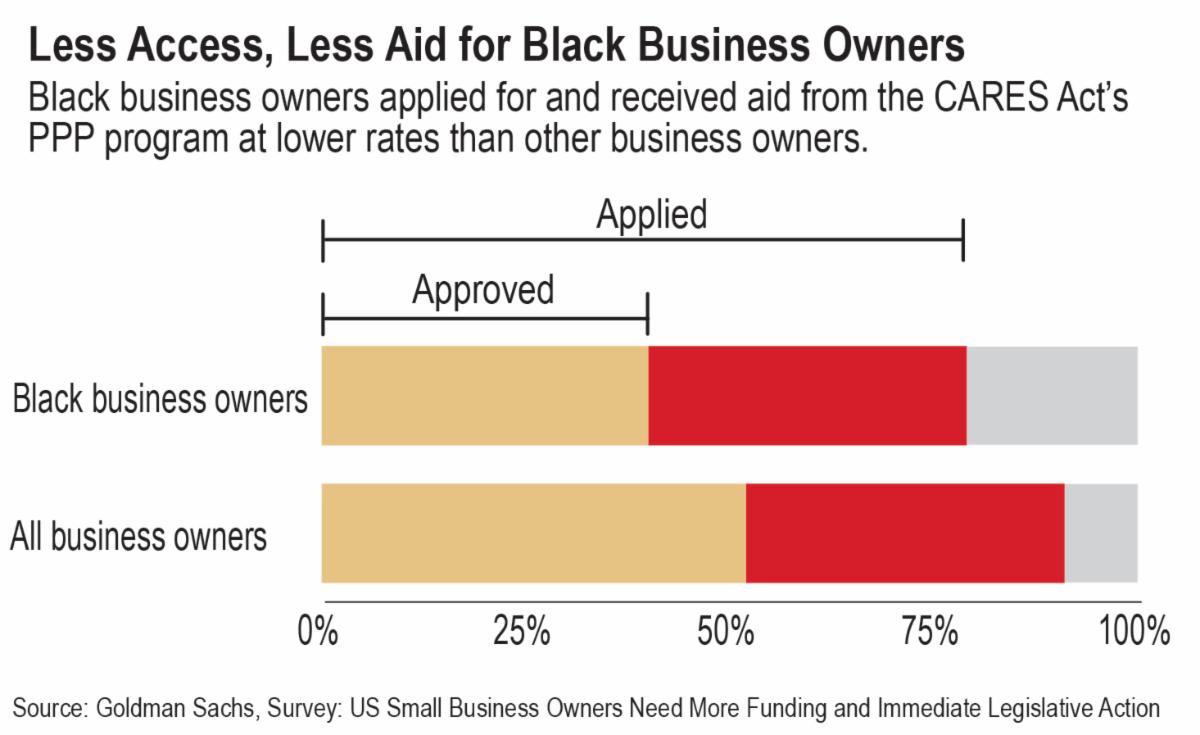

Even as Black enterprise entrepreneurs experience specially critical economic impacts as a final result of the pandemic, they are getting significantly less support than the rest of the inhabitants. A absence of preexisting banking relationships has barred numerous Black company house owners from accessing funds from the Paycheck Security Program (PPP), which offers financial loans to small enterprises to use for payroll charges, house loan curiosity, hire, and utilities. According to just one study performed in April, 79% of Black company entrepreneurs have used for a PPP mortgage, as opposed to 91% total, and 40% of Black organization proprietors have been accredited for a PPP financial loan, in comparison to 52% over-all. At a time when so quite a few Black enterprise homeowners are in desperate need of support, it’s important that lawmakers get the job done to present better access to support.

Conclusion

As Virginia’s firms begin to reopen and employment starts to development upward, it is vital to realize that the financial fallout of the pandemic is much from over. This is specially true for Black homes that, owing to a extended historical past of policymakers erecting obstacles to achievements and financial option for communities of color, are a lot less capable to respond to career and profits losses with the use of financial savings. Substantially extra requires to be completed both equally to enable the most difficult strike associates of our community get by means of this unique crisis, and to make systemic changes to rebuild Virginia’s overall economy in a more equitable way. Accessibility to paid family members and clinical leave, even further funds support, and strengthened unemployment payment can help Black staff and business enterprise entrepreneurs commence to recover from the financial losses caused by the pandemic. And by advancing policies that address discrimination and split down obstacles to education, fantastic-paying employment, wealth, and other suggests of economic possibility, Virginia can rebuild a far more equitable economic climate going forward.

— Morgan Ackley, Analysis Intern, and Laura Goren, Analysis Director

Print-friendly Version (pdf)

Find out much more about The Commonwealth Institute at www.thecommonwealthinstitute.org