Market stability begins to fray as oil slump piles on the pain

The biggest oil price crash in almost three decades has deepened the market stress caused by the coronavirus outbreak, leaving traders reeling and leading to mounting signs of strain and dislocation in financial markets.

Government bonds have been shooting higher and stocks have been sliding for more than two weeks, but while prices have moved a long way, market conditions have been mostly smooth and orderly.

That started to crack on Monday. After Saudi Arabia’s decision over the weekend to start an all-out price war sent crude crashing, currencies and stocks began to move unusually sharply.

“Today is the first day when we can see markets become really dysfunctional,” said Luca Paolini, chief strategist at Pictet Asset Management. “This feels really bad.”

Signs that Monday would be a historic day for markets became clear in the first light of day in Asia, when US equity futures on the Chicago Mercantile Exchange tumbled 5 per cent and hit their permitted trading limits. The CME, the world’s largest futures exchange, also raised margins on a series of interest rates, currencies, metals and agriculture futures overnight.

When Asian stock markets opened, Japanese equities quickly slipped into a bear market — defined as a 20 per cent drop from their recent peak. Asian currencies markets also experienced large swings that pushed the Japanese yen to its highest point against the dollar since October 2016. More alarmingly, the Australian dollar shed 3 per cent of its value in just three minutes to hit its lowest level against the dollar since the financial crisis.

The Australian currency had been under pressure in the 20 minutes leading up to the crash, but at 1.49am in London the exchange rate lurched lower, sinking to almost $0.63 in just a minute before recovering to around $0.645. “It was definitely a flash crash in my view,” said Xavier Porterfield, head of research at data company New Change FX.

It proved to be a sign of things to come when European markets started trading. Dozens of stocks on the London Stock Exchange were temporarily suspended when the market opened. On Xetra, the German exchange, there were 1,300 “volatility interruptions” — when trading is slowed down — within the first three hours. That surpassed the total on the day after the UK’s referendum on leaving the EU.

The stress continued when the US stock market opened, with the S&P 500 immediately sliding 7 per cent and triggering a market-wide “circuit breaker” designed to curb panicked selling by forcing a 15-minute halt to trading. That was the first time the measure had been used since it was introduced in 2013. But the pause provided little respite.

“Markets were already grappling with an unknown and uncontrollable problem with the coronavirus, and now they’ve been hit by a huge oil shock,” said Peter van Dooijeweert, head of institutional hedging at Man Group. “We’re seeing signs of stresses everywhere.”

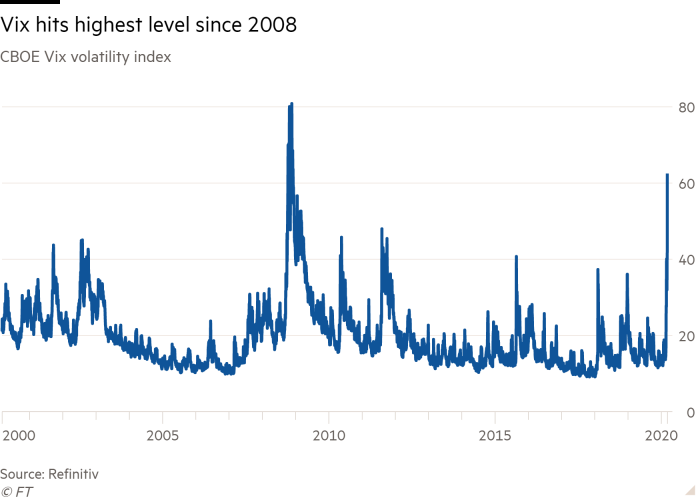

Although the past few weeks have been volatile, this was a new degree of turbulence. In the initial stages of the sell-off in late February investors and traders stressed that markets had been orderly.

But liquidity has been deteriorating in many important markets. That has meant that falls have become sharper and more jagged than normal. By Monday trading conditions were exceptionally difficult.

“It feels like everything is creaking right now,” said one equities broker who declined to be identified. “It’s just fear and panic in the same way that a member of the public goes out and bulk-buys toilet roll.”

The most noticeable example is in the US futures market. Its “depth” — as measured by how many contracts are quoted near the best price — has collapsed by about 90 per cent from mid-February, according to JPMorgan. Traders and fund managers also said deteriorating liquidity was apparent in the bond market.

Even highly rated government debt, normally the most tradeable of asset classes, has not been immune, as the spreads between offers and bids have widened.

“There have been some air pockets before, but today is the first really big one,” said Mike Riddell, a fund manager at Allianz Global Investors.

The US Federal Reserve is taking steps to try to ensure market conditions do not deteriorate. On Monday it said it would pump extra liquidity into short-term lending markets.

The measures come at a time when many trading floors have been hollowed out, with several banks and hedge funds allowing employees to work in disaster recovery sites, or from home, to minimise the risk of spreading disease. Traders report that the relocations have taken effect at a tough time — just as volatility has picked up and volumes have doubled.

“How much risk do you feel comfortable with when you’re working from home? For trading desks and asset managers, that will just compound the problem of poor liquidity,” said Man Group’s Mr van Dooijeweert.