NexPoint Real Estate Finance’s (NYSE:NREF) investors will be pleased with their 26% return over the last year

If you want to compound prosperity in the stock sector, you can do so by purchasing an index fund. But traders can improve returns by buying marketplace-beating firms to very own shares in. For example, the NexPoint Real Estate Finance, Inc. (NYSE:NREF) share value is up 15% in the last 1 calendar year, plainly besting the industry decline of about 15% (not which include dividends). That’s a stable general performance by our criteria! Be aware that organizations frequently establish about the lengthy phrase, so the returns about the previous yr could not replicate a extensive expression pattern.

Now it really is truly worth possessing a search at the firm’s fundamentals much too, simply because that will aid us identify if the extended phrase shareholder return has matched the effectiveness of the fundamental business.

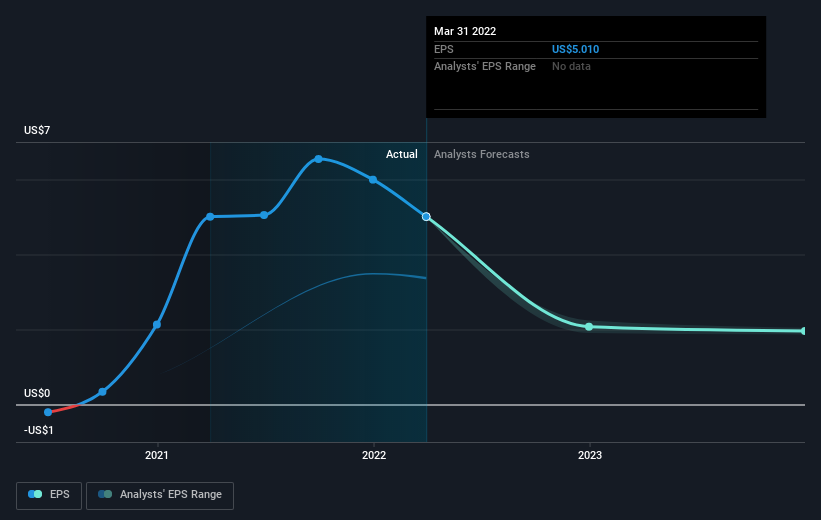

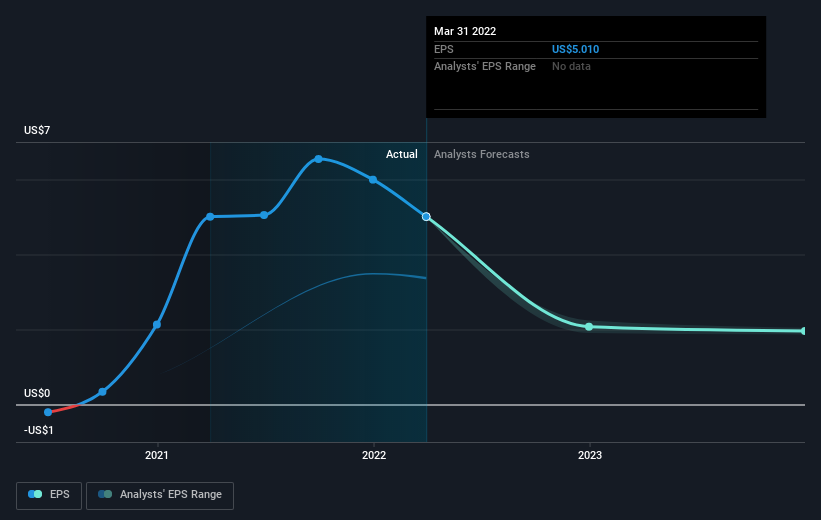

Although the productive marketplaces hypothesis continues to be taught by some, it has been verified that marketplaces are over-reactive dynamic programs, and investors are not generally rational. 1 flawed but affordable way to evaluate how sentiment all-around a firm has modified is to evaluate the earnings per share (EPS) with the share selling price.

Through the final year NexPoint Genuine Estate Finance grew its earnings for each share (EPS) by .04%. This EPS growth is appreciably decrease than the 15% improve in the share value. This implies that the sector is now additional optimistic about the inventory.

You can see underneath how EPS has modified in excess of time (find out the exact values by clicking on the image).

It is almost certainly worthy of noting that the CEO is compensated considerably less than the median at identical sized corporations. It truly is always truly worth retaining an eye on CEO pay, but a a lot more essential query is whether the enterprise will grow earnings through the yrs. Ahead of shopping for or selling a stock, we normally advocate a near assessment of historic progress tendencies, offered listed here..

What About Dividends?

When hunting at investment decision returns, it is critical to think about the distinction concerning total shareholder return (TSR) and share price tag return. The TSR is a return calculation that accounts for the benefit of dollars dividends (assuming that any dividend received was reinvested) and the calculated price of any discounted capital raisings and spin-offs. It is really honest to say that the TSR gives a more full photograph for stocks that pay out a dividend. In the circumstance of NexPoint Real Estate Finance, it has a TSR of 26% for the previous 1 year. That exceeds its share price tag return that we formerly pointed out. The dividends compensated by the business have thusly boosted the complete shareholder return.

A Unique Point of view

NexPoint Authentic Estate Finance boasts a overall shareholder return of 26% for the final year (that involves the dividends) . Regretably the share selling price is down 3.5% about the last quarter. Shorter expression share value moves often do not signify considerably about the organization itself. Even though it is well well worth thinking of the different impacts that market problems can have on the share price tag, there are other variables that are even far more essential. To that conclusion, you should study about the 3 warning indicators we have noticed with NexPoint Real Estate Finance (which include 1 which isn’t going to sit much too well with us) .

We will like NexPoint Genuine Estate Finance better if we see some big insider purchases. While we hold out, examine out this absolutely free listing of rising firms with considerable, latest, insider obtaining.

Please observe, the market returns quoted in this write-up reflect the market weighted normal returns of stocks that at the moment trade on US exchanges.

Have suggestions on this short article? Anxious about the articles? Get in contact with us instantly. Alternatively, e mail editorial-staff (at) simplywallst.com.

This short article by Simply just Wall St is common in mother nature. We offer commentary based on historical knowledge and analyst forecasts only employing an impartial methodology and our article content are not meant to be monetary guidance. It does not represent a recommendation to invest in or promote any inventory, and does not just take account of your aims, or your fiscal condition. We intention to bring you long-term concentrated examination pushed by elementary data. Notice that our examination may well not variable in the hottest value-delicate corporation announcements or qualitative product. Basically Wall St has no place in any stocks mentioned.

The sights and thoughts expressed herein are the views and opinions of the writer and do not essentially replicate people of Nasdaq, Inc.