Popular (BPOP) Inks a Deal with Evertec, Amends Contracts

Well-known, Inc. BPOP and its wholly-owned subsidiary, Banco Preferred de Puerto Rico, (“BPPR”), inked a offer with Evertec, Inc. EVTC and Evertec Team, LLC. to improve the ongoing electronic transformation and enrich the consumer encounter. For each the offer, Well known will receive property and believe liabilities used by Evertec to service specific BPPR channels. The transaction is expected to near on or about Jun 30, 2022, on receipt of specific customary closing conditions.

– Zacks

In conjunction with the offer closure, Well-known and BPPR will extend and amend company agreements, per which Evertec provides payment processing as well as information know-how and products and services, and other companies. The agreements’ modifications will get rid of assistance exclusivities. It will also diminish support costs resultant from discounted pricing and decreased caps on contractual pricing escalators tied to the Client Value Index.

The alterations in agreements are also predicted to hone Popular’s competency in well timed shopper need achievement, aside from providing possibilities to develop and make improvements to technology platforms, and find company vendors.

At the good results of the acquisition, BPPR will amend and increase the deal governing its service provider acquiring relationship with Evertec. The new agreement will aid BPPR with revenue sharing, aside from deepening its partnership with Evertec in payments.

Well-liked will deliver 4,588,955 shares of Evertec frequent stock it retains, valuing the transaction at $196.6 million. Right after the transaction is closed, Popular’s ownership stake in Evertec is predicted to be 10.5%.

Well known will also history an right after-tax get of approximately $135 million owing to the use of Evertec shares as purchase thing to consider. What’s more, the effects of the reduction of Popular’s participation in Evertec beneath 4.5% are projected to garner $215 million in soon after-tax gains.

Common programs to return right after-tax gains resulting from this sort of sale to its shareholders by means of inventory repurchases, subject to the receipt of regulatory consents.

Excluding these gains, the monetary rewards of the agreement throughout the first whole yr are predicted to be neutralized owing to Popular’s earnings riddance from its equity investment decision in Evertec and the subsequent reduction in voting ownership stake. Nevertheless, the transaction’s financial impacts are predicted to be accretive in upcoming decades on the grounds of incremental service provider buying income-sharing profits and upcoming price tag cuts in continuing providers.

At or right after the closing of the acquisition, Well-known expects to insert 175 workers and contractors to assistance with the servicing of the crucial channels, and bolstering and maximizing Popular’s in-household technological innovation bench.

Ignacio Alvarez, president and CEO of Well-known, remarked, “This transaction will boost our shopper expertise and make it possible for us better flexibility to meet up with our buyer requires. Evertec will continue to be a vital strategic associate and we seem ahead to functioning together to build on our payments technique.”

Mac Schuessler, Evertec’s president and CEO, stated, “This transaction represents the upcoming action in a multi-year method that started out again in 2015 of repositioning Evertec as a leading payment player in the region and an necessary lover to Banco Common solidifying our partnership with our biggest consumer.”

Summary

We feel that the corporation is effectively-poised to capitalize on its foremost place in the Puerto Rico sector. Additionally, a strong capital and liquidity position favors such acquisitions.

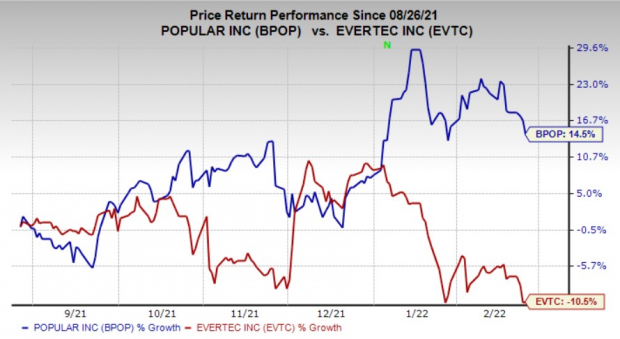

Shares of BPOP have acquired 14.5% in the past 6 months, whilst Evertec’s stock has recorded a 10.5% fall.

Impression Source: Zacks Financial investment Study

BPOP sports activities a Zacks Rank #1 (Powerful Obtain) at existing. You can see the entire record of today’s Zacks #1 Rank shares in this article.

In the meantime, EVTC carries a Zacks Rank #4 (Provide).

Inorganic Progress Efforts by Other Companies

Numerous companies from the finance sector are building consolidation efforts to enhance competencies to counter the reduced fascination-rate environment.

Walker & Dunlop, Inc. WD inked a deal to get GeoPhy, a professional real estate engineering organization. The transaction, anticipated to be total in the initially quarter of 2022, is topic to approvals.

Per the conditions of the transaction, Walker & Dunlop will pay $85 million in money at the closing in addition to $205 million of income receive-out probable. The funds generate-out potential is structured to instantly align with WD’s Travel to ’25 aims.

Truist Money Corporation’s TFC subsidiary, Truist Insurance coverage Holdings, Inc., signed an agreement to acquire Kensington Vanguard Countrywide Land Expert services. The deal is envisioned to close in the first quarter of 2022. The specifics of the transaction are not nonetheless disclosed.

The transaction is envisioned to assist Truist Insurance plan in expanding its organization in title insurance policy. The current title procedure of TFC is BridgeTrust Title, which will very likely be integrated with Kensington Vanguard.

Infrastructure Stock Growth to Sweep The united states

A substantial press to rebuild the crumbling U.S. infrastructure will quickly be underway. It is bipartisan, urgent, and inevitable. Trillions will be put in. Fortunes will be made.

The only dilemma is “Will you get into the appropriate shares early when their growth prospective is biggest?”

Zacks has unveiled a Exclusive Report to enable you do just that, and these days it is no cost. Explore 5 particular businesses that search to gain the most from building and fix to roadways, bridges, and buildings, plus cargo hauling and power transformation on an pretty much unimaginable scale.

Down load Absolutely free: How to Profit from Trillions on Paying out for Infrastructure >>

Want the hottest tips from Zacks Expense Research? Now, you can down load 7 Finest Shares for the Up coming 30 Days. Click to get this cost-free report

Popular, Inc. (BPOP): Free Inventory Analysis Report

Walker & Dunlop, Inc. (WD): No cost Stock Investigation Report

Evertec, Inc. (EVTC): Free of charge Inventory Investigation Report

Truist Fiscal Company (TFC): No cost Inventory Analysis Report

To go through this write-up on Zacks.com simply click listed here.

Zacks Financial commitment Study