Rise in margin lending stokes fears of China bubble

Margin loans to buy equities in China have risen to their highest level in five years, prompting fears that speculation on rising prices could lead to a rerun of a notorious stock market bubble that burst in 2015.

Total margin finance in China reached Rmb1.27tn ($184bn) on Tuesday after more than a week of consecutive daily increases, according to Wind, a data service. Separate figures show investors rushing to open new accounts that give them access to loans from brokers.

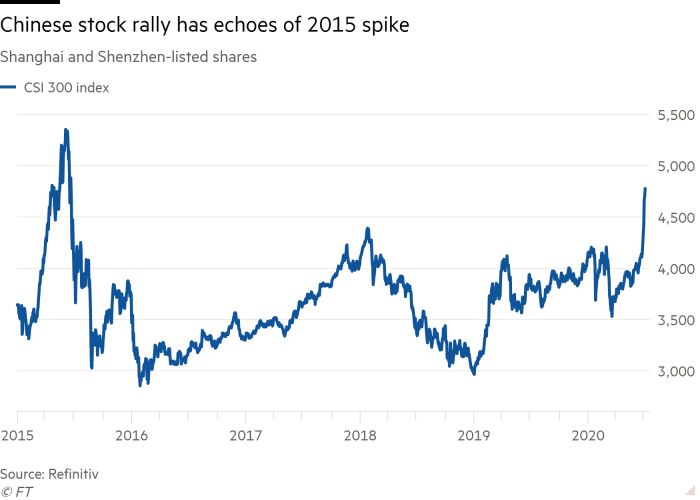

The CSI 300 index, a gauge of the country’s biggest stocks listed in Shanghai and Shenzhen, leapt almost 6 per cent on Monday and continued to climb on the following days, after state media extolled the benefits of a “healthy” bull market at a time when the coronavirus pandemic has hit economic activity.

But the rally has drawn comparisons with the events of 2015, when state media urged individual investors to pile in to stocks as the economic backdrop weakened. Sustained in part by a crescendo of margin lending, prices doubled over the course of a year before losing more than 40 per cent of their value in a matter of months.

“I think people are getting greedy, because liquidity is abundant and there is policy support from the top,” said Hao Hong, head of research and chief strategist at Bocom International. “You can sense the speculative atmosphere.”

Trading on margin can be risky, because if the value of collateral falls the borrower may have to deposit more cash or securities. Pledged assets can also be sold without a customer’s consent, perhaps at fire-sale prices.

Margin lending is still well below the peak it reached in 2015, when it rose above Rmb2.2tn in June after doubling from its levels in February, according to Wind. But analysts say the momentum resembles the early stages of the previous boom.

On Monday turnover in “A shares”, which trade on the two main exchanges, was Rmb1.57tn, according to Morgan Stanley. That marked the highest level since the 2015 correction, indicating “high participation from not only institutional but also retail investors”, the bank’s analysts said.

Mr Hong estimates that so far this month about 12 per cent of daily trading volumes are being completed through access to margin finance, compared with 8 per cent in late June. That kind of proportion “tends to raise eyebrows”, he said.

Data from the China Securities Finance Corporation, a state-owned company which provides the country’s brokers with funding, showed that over 85,000 new margin trading accounts were opened in June — more than a one-third increase on the average over the previous year.

One user on Weibo, a popular social media site, noted that securities companies “that had not been in contact in a long time” were again advertising services offering margin trading.

Late on Wednesday, China’s securities regulator published a list of 258 illegal funding platforms, which it said were currently offering leverage of up to ten times to investors. Under Chinese law, only approved brokers can provide securities financing.

Support for the capital markets has come alongside measures from China’s central bank to reduce the cost of credit as the economy grapples with the consequences of the pandemic.

“The government has been gradually loosening its monetary policy, so some of this loosening will find its way into the stock market,” said Nicholas Yeo, head of China equities at Aberdeen Standard Investments in Hong Kong.

Despite apparent cheerleading for the market across state media outlets, some suggest the government, wary of the events of 2015, will exercise caution when it comes to allowing investors to bet with borrowed money.

Ken Cheung, chief Asian foreign exchange strategist at Mizuho, expects leverage will remain the main driver of the market in the “medium term”, but expects the government to keep it at a “more controllable rate”. He noted that state media “refrained from adding fuel to the fire” after Monday’s rapid move upwards.

Morgan Stanley analysts say that margin finance appears moderate for now, equivalent to about 4 per cent of the total capitalisation of the stock market, compared to about 10 per cent at the peak in 2015. New investor registrations, meanwhile, despite rising sharply month-on-month, are a long way from the 700,000 of December 2014.

That could indicate that the rally has further to run. Michael Every, global strategist at Rabobank, says China’s market is just one example of a wider trend, also present in the US, where governments seek to boost sentiment while their economies are under heavy pressure.

“If you have a strategy of just pumping up asset prices, it’s going to end in tears,” he said. “We would all sleep much better if this was all fundamentals-driven, everywhere.”