Rising Rates Are The Stock Market’s Kryptonite

Torsten Asmus/iStock through Getty Photographs

The renowned newsletter author and market timer Joe Granville coined lots of a renowned witticism in his time, several of them still in use nowadays. His most popular just one, “The apparent is definitely improper,” inevitably turned the unofficial mantra of current market contrarians almost everywhere. “As soon as you imagine you‘ve got the important to the inventory industry, they improve the lock,” is another well-identified Granville-ism.

While most of Granville‘s bromides were being pithy and (mainly) correct, at the very least one particular of his oft-repeated observations skipped the mark. At an expenditure meeting numerous a long time ago, he once posed the following rhetorical issue: “What do curiosity fees have to do with the stock market place?” “Naaahthing!” was his sardonic solution.

With respect to the late, fantastic market timer, I will have to emphatically disagree. Interest fees are in simple fact intimately relevant to the equity current market and can have an outsized influence on the way of stock charges. Don‘t believe me? Then just appear at what has took place to the fairness current market this year since bond yields began soaring.

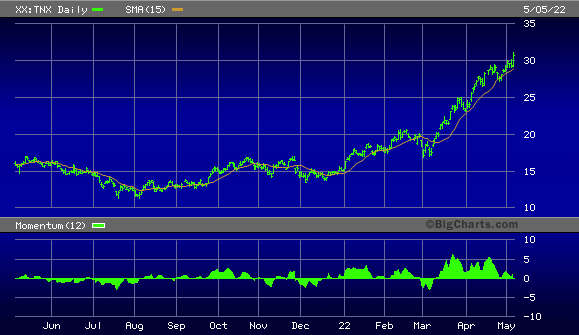

A vacation down the memory lane of current background should suffice to more show this proposition. In the months prior to the 20% inventory market correction of late 2018, premiums across the spectrum of Treasury bond maturities were being on the rise on a continuous basis, with the 10-12 months Treasury Generate Index (TNX) soaring from 2.4% to over 3.2% (up 33%) in a 10-thirty day period interval.

At the similar time, the variety of 52-7 days lows on equally the NYSE and Nasdaq were being elevated to extremely high concentrations for numerous months, led largely by bond funds and other cash flow securities. Far more than just one current market analyst dismissed the stressing increase of the new 52-week lows at that time by stating that bond cash should be disregarded since they aren‘t seriously shares. Hence, there was absolutely nothing to worry about, they stated.

They had been incredibly improper. Finally the pressure of growing costs, coupled with the Federal Reserve tightening monetary coverage, was way too much for the wide equity market to bear. Stocks cascaded decrease commencing in October 2018 and fell steadily into late December just before lastly bottoming out.

Rapid forward to 2022. This time about, the 10-calendar year generate has risen from 1.2% to more than 3% in just nine months—up a spectacular 150%—which is developing remarkable cross-currents and headwinds for stocks. Now, as in 2018, new 52-7 days lows on the two main exchanges continue to be particularly elevated (nicely into the triple digits on most days) with charge-delicate bond cash accounting for most of the marketing pressure.

Presently we‘ve noticed a official “correction” (outlined as a 10% or increased drop) in the S&P 500 Index and an outright bear marketplace (down in excess of 20%) in the Nasdaq Composite. Both equally activities could conveniently be attributed to the negative effect of mounting costs.

Even though both equally the S&P 500 and the Nasdaq have experimented with various periods to bottom lately, the price-similar weakness has the moment all over again crept into the fairness current market in a expanding variety of sectors. The 5% pullback in the Nasdaq Composite at the time of this creating on May 5, led by various significant expansion-oriented names, has once once again highlighted the adverse impression of climbing charges.

Meanwhile, the hottest thrust to new highs in the 10-year generate index demonstrates the rising concern of quite a few traders that a bear marketplace could shortly grow to be recognized if prices keep on alongside their current course.

BigCharts

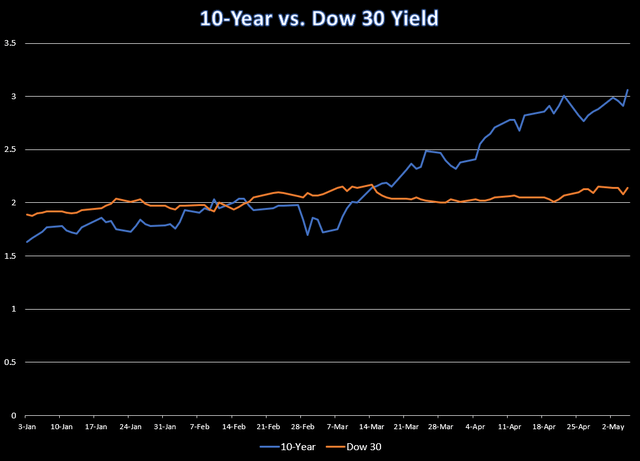

A vital rationale why growing prices are inclined to be damaging for fairness costs is owing to the levels of competition for financial commitment funds from cash flow-oriented individuals. With U.S. govt bond yields now properly over the regular yield for the Dow 30 inventory index, cash is relocating away from shares and gravitating toward bigger-yielding bonds.

WSJ, Author’s Chart

Historically, every time the hole involving 10-yr bond and Dow 30 yields has widened in

favor of bonds, shares have tended to underperform. Therefore my assertion that climbing fees are the stock sector‘s “kryptonite.“

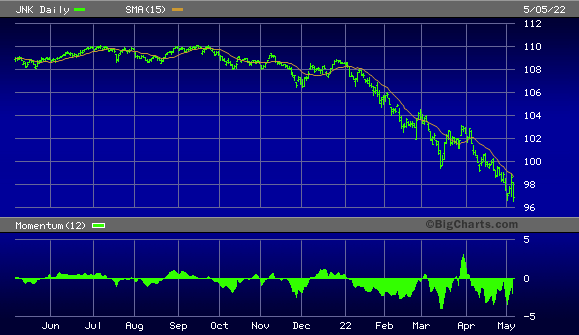

Large-produce corporate, or “junk,” bonds are also in a precarious affliction as price ranges have been persistently slipping although yields rise. The SPDR Bloomberg Higher Yield Bond ETF (JNK) has been a reliable indicator for a main drop in stocks any time the downward trend in JNK has been constant for quite a few months (as it was prior to the 2018 collapse). If the chart below is any sign, stock buyers can assume above-normal volatility ranges in the coming months.

BigCharts

There is, nonetheless, a opportunity that shares can dodge the interest fee “bomb” if the rising level pattern swiftly reverses in the near expression. And although the bond bears are still pretty much in cost appropriate now, there are some sentiment- and technical-linked measures that counsel a bottom in bond yields (each corporate and Treasury) could take place in the subsequent a number of months.

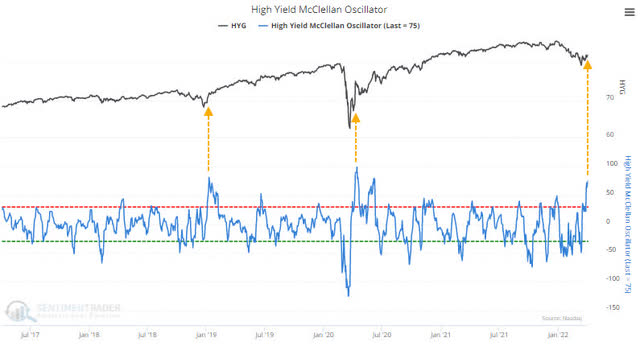

One particular of them is the McClellan Oscillator for the superior-yield bond market place has just soared to its greatest (i.e. most oversold) amount due to the fact the March 2020 crash. (This indicator examines big difference among shorter- and medium-term going averages of the internet variety of advancing junk bonds on a day-to-day foundation). As SentimenTrader‘s Jason Goepfert not long ago observed, it just strike +75 for only the 3rd distinct time in the past 5 yrs last thirty day period, as the following graph exhibits.

SentimenTrader

And while this alone doesn‘t guarantee a reversal for bond yields will take place, it does give the bulls a prospect at recovering manage of the limited-expression development primarily based on the obvious construct up in short curiosity in the large-yield bond market place. In other terms, it likely wouldn‘t acquire considerably to bring about a shorter-covering rally in bond price ranges (and a corresponding decline in yields).

For now, having said that, the principal proof favors a defensive stance for equity market place contributors and holding off on making big commitments in riskier parts of the stock industry. And till the mounting bond generate craze reverses, the stock market place will have a key headwind to contend with.