US companies scurry back to IPO market after rapid recovery

Companies are pulling forward plans to go public in the US, responding to a surge in demand for new stock market listings that just culminated in the busiest week in a year.

This week delivered $3bn in proceeds from initial public offerings, the biggest haul since May last year. Excitement peaked on Wednesday when the two biggest deals since the Covid-19 crisis were expanded after orders exceeded the amount of stock on offer.

In the morning, Warner Music priced its shares near the top end of the pre-flagged range and increased the offering by a tenth to $1.9bn — making it the year’s largest US flotation so far. By the evening, ZoomInfo, a marketing software company, had priced above its previously set range to raise $935m. On Thursday, after ZoomInfo’s stock rose more than 60 per cent on debut, fintech Shift4 Payments priced its imminent flotation above the previously set range, raising $345m.

The healthy demand for the deals reflected a renewed vigour among equity investors. US stocks have risen more than 40 per cent since their March low, completing the strongest 50-day run in history, fuelled by optimism over the global rebound from the coronavirus pandemic.

“We’re seeing demand as strong or stronger than we saw before the Covid-19 crisis,” said Paul Abrahimzadeh, co-head of North American equity capital markets for Citi. “You’re going to see a lot more IPOs coming.”

Carter Mack, president of JMP Group, said he is working with a dozen companies on listings at the moment — a “record backlog” that includes four groups considering moving their listing one month forward to June.

Vroom, the used car sales app, is set to price on Wednesday, and a series of other deals are waiting in the wings, according to bankers. A listing for Albertons, the supermarket chain, is weeks away, according to a person with knowledge of the deal. DoorDash and Postmates — rivals in the food delivery business — are also among the companies known to be considering a listing.

Palantir, the data-mining group that has considered a listing for years, fanned expectations of a share sale last month after Alex Karp, its chief executive, said in an interview with Axios that a deal could occur within a year.

The IPOs done so far this year are dominated by technology and healthcare groups — the two best-performing sectors of the US stock market in 2020.

Greg Chamberlain, head of US technology, media and telecommunications equity capital markets for JPMorgan Chase, said the flurry of listings will encourage companies that have submitted their paperwork to press ahead.

“The recent IPOs reinforce the idea that equity investors are embracing high-quality growth companies right now,” Mr Chamberlain said. “If companies are ready, there is a good window available.”

An uptick in listings is likely to include a broader set of sectors, added Jim Cooney, head of equity capital markets for the Americas at Bank of America. “We’re seeing an acceleration in IPOs and the near-term pipeline is broader than just tech and healthcare,” he said.

Helping the deal flow is the drop in the Cboe Vix index of market volatility. The benchmark, known as Wall Street’s “fear gauge”, surged above 80 in March to a record high, but fell to 26 points this week, a level not seen since February. Less than a tenth of $100m-plus deals in the US have occurred when the index is above 25 points, according to Dealogic data going back to 2000.

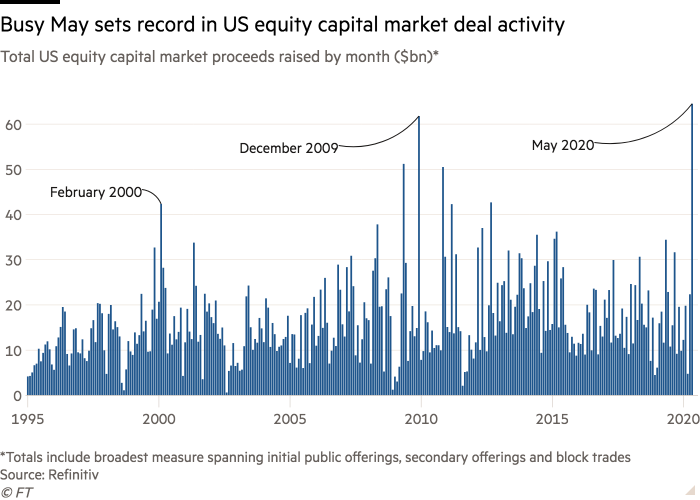

The recovery in sentiment has helped to push the total amount issued across equity markets — from new listings to secondary offerings and big block trades — to $65.5bn in May. That was the highest monthly total on record, edging ahead of the sum raised in December 2009. The May tally included big secondary offerings from Shopify, the Canadian ecommerce group, and PNC Financial’s $13bn sale of its stake in BlackRock.

The surge in equity issuance has been mirrored in debt markets, where US investment-grade bond issuance has already surpassed $1tn for the year.

Yet for all the optimism over dealmaking, doubts linger about asset prices. Many investors worry that the rally has become detached from reality given some dire economic forecasts, while protests over police brutality have swept the US and tensions with China have risen. The presidential election in November provides another potential source of volatility for would-be issuers.

“The risk of the unknown and a potential sell-off is top of mind for many people,” said Mr Cooney of Bank of America. He noted that issuers who are able to “accelerate” their listing plans are doing so, “since market conditions later this year may be more uncertain.”