US on track for worst corporate quarter since financial crisis

A drop in US corporate profits in the first quarter underscores a dire year for blue-chips but has failed to dent the optimism underpinning a bumper rally in the stock market.

Companies in the S&P 500 are on pace to trim earnings per share by 14 per cent for the first quarter, which would be the largest annual decline in the index since the third quarter of 2009, according to FactSet.

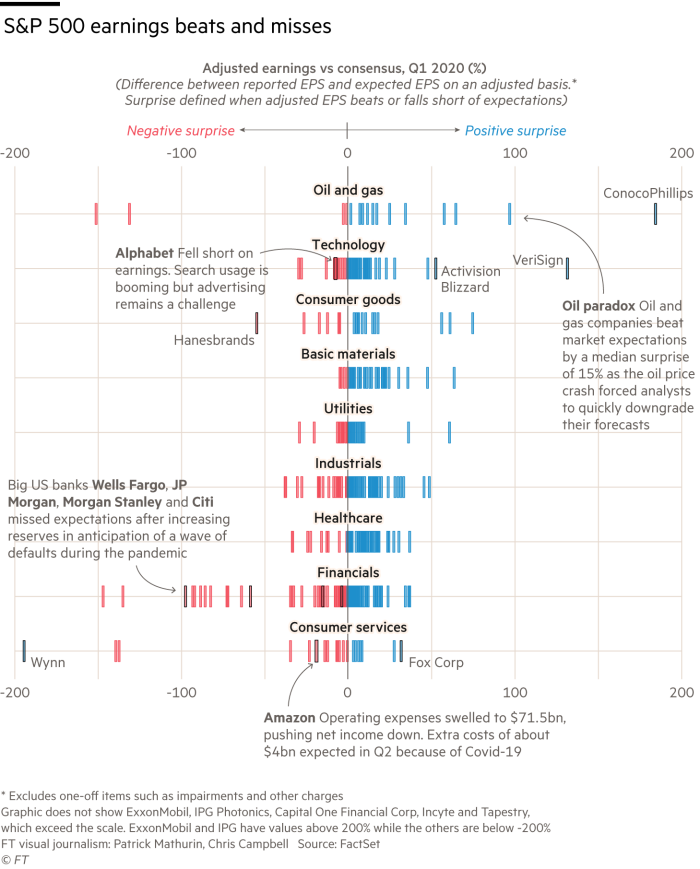

Despite the drop, bright spots have emerged. Two-thirds of companies that have reported so far have exceeded analyst estimates, with technology and healthcare companies among the best performing, according to Financial Times analysis.

“Paradoxically, first-quarter US earnings season has been marginally better than expected,” said Sean Darby, head of global equities for Jefferies. “The caveat is that both forward earnings and sales estimates are still being dropped globally.”

IPhone maker Apple reported sales and earnings that beat expectations, despite the pandemic forcing store closures and factories to shut. Microsoft exceeded Wall Street forecasts by revealing a huge surge in demand for its cloud business.

Goldman Sachs anticipates earnings per share for US blue-chips to crater by a third this year before rocketing back in 2021 to levels beyond those reached last year, driven by a robust recovery to the downturn caused by coronavirus. This rosy outlook helps explain the swift rally in the stock market that has added a quarter of value to the S&P 500 since the recent low in March, partially retracing the dramatic fall earlier this year as the health crisis swept the globe. However, not all analysts share the optimism implied by the recent increase in stock prices.

“There seems to be a disconnect — the markets are not looking at the current fundamentals, they’re looking out to the second half of the year and 2021,” said Nela Richardson, investment strategist with Edward Jones. “The market is ahead of the recession and is already anticipating a recovery.”

Expectations for US company profits should come down as forecasts for economic growth fall, said John Vail, chief global strategist at Nikko Asset Management. “There will be several industries that will be shadows of their former selves.”

The drop in the price of oil, which has dragged energy companies down 40 per cent this year, making it the worst-performing sector in the S&P 500, will also weigh on future corporate profits, said Mr Vail. “The oil price will be a major swing factor in what happens to earnings next year. The outlook is very challenged, especially for the airline industry.”

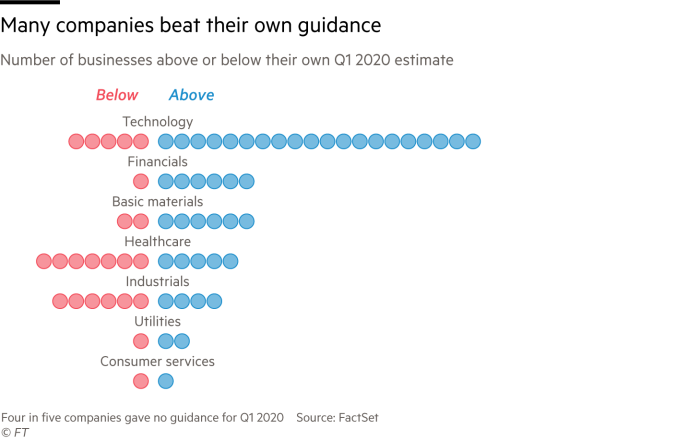

Results for technology and healthcare companies have been among the standouts for the period. Three-quarters of technology groups’ reported earnings more than 1 per cent above analysts’ estimates with four-in-five surpassing their own market guidance.

Technology companies, such as software providers, are primed for an increase in uptake as millions of people work remotely in the US. These companies tend to have a lower cost base, giving them extra leeway for the downturn.

Health groups have also gained in the crisis. Analysts also expect a bump in elective procedures once the virus abates as non-urgent surgeries resume. Share prices benefited from Joe Biden becoming the Democratic nominee for the presidential race later this year, dimming the chances of broad healthcare reform.

The extent of Covid-19 on profits will be more revealing next quarter.

“The first quarter — and the expectations being set for the second quarter — is a tale of two cities,” said David Polak, equity investment director for Capital Group. Home delivery and online software groups are set to benefit from the lockdowns while companies in other sectors like transport or travel face major challenges, he said. “There are companies where the situation is quite dire.”