Wall Street closes higher on vaccine and reopening hopes

Global stocks surged as investors took heart that the gradual easing of lockdowns in Europe would stimulate global economic growth, while also drawing encouragement from a US trial for a Covid-19 vaccine.

Trader optimism was underpinned by comments from Federal Reserve chairman Jay Powell over the weekend that the central bank had more in reserve to support the US economy if required.

Hopes of rising economic demand also pushed the price of US crude oil to its highest level in two months, reflected in a Monday morning tweet from US president Donald Trump: “Oil (energy) is back!!!!”.

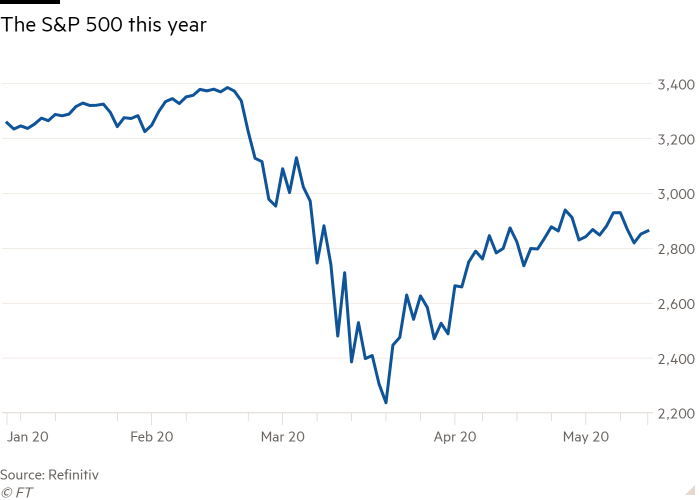

Wall Street made strong gains on Monday, with the S&P 500 rising 3.2 per cent to notch its highest close since early March.

The Dow Jones Industrial Average advanced almost 4 per cent, while the tech-heavy Nasdaq Composite jumped 2.4 per cent.

In morning trading in Asia on Tuesday, Japan’s Topix stock index rose 1.7 per cent and Hong Kong’s Hang Seng gained 2 per cent.

“With low government yields everywhere, investors can even justify some of the steep price-to-earnings multiples [on stocks] that have raised so many eyebrows,” said Christopher Smart, head of the Barings Investment Institute.

“Even if some markets look overly optimistic about the grim recovery ahead, next quarter will likely be better than this quarter, and next year will likely be better than this year,” he said.

Investor sentiment was also boosted after Boston-based biotech company Moderna said its potential coronavirus vaccine had delivered positive results in early small-scale human trials.

Expectations for an economic rebound from the pandemic, coupled with strong central bank support, have helped drive the recent sharp rise in equity markets. The S&P 500 is up nearly 35 per cent from a low hit in late March.

European shares gained on optimism that a gradual easing of the lockdowns across the region had not yet caused a significant fresh outbreak of infections. London’s FTSE 100 rose 4.3 per cent and the continent-wide Stoxx Europe 600 climbed 4.1 per cent.

Frankfurt’s Dax Xetra soared 5.7 per cent after the German central bank declared “a recovery is under way” in Europe’s largest economy.

The Bundesbank activity index, which measures economic activity based on real-time indicators such as toll road traffic and electricity usage, stood at minus 4.6 per cent for April — a level that points to a shallower recession than many economists had forecast.

“Although measures of services activity remain depressed across Europe, we have started to see tentative improvement in high-frequency activity indicators in countries that have already lifted restrictions,” said Sven Jari Stehn, an economist at Goldman Sachs.

Investor confidence was bolstered by remarks from Mr Powell on the 60 Minutes programme that the central bank “wasn’t out of ammunition by a long shot” to support the economy at a time when states loosen their restrictions on movement and social contact.

However, in the interview on Sunday, Mr Powell also warned that a full US economic recovery might take until the end of next year and require the development of a Covid-19 vaccine.

“It does feel like we’re in the middle of a phoney war at the moment with all of us waiting to see how efficiently the various economies are able to reopen given all the social distancing that will be required,” said Jim Reid, strategist at Deutsche Bank.

Futures on West Texas Intermediate, the US crude benchmark, rose more than 8 per cent to settle at $31.82 a barrel on Monday as oil demand showed signs of picking up and supply cuts led by Opec began to take effect. It was the first time the contract had risen above $30 since mid-March.

A month ago, US crude prices collapsed into negative territory for the first time as a lack of storage capacity forced producers to pay buyers to take barrels off their hands.

Fears of a similar price collapse ahead of the expiry this week of the US crude futures contract for delivery next month appear to have subsided.

“The relative improvement in sentiment toward crude and easing concerns over whether storage was reaching tank tops should prevent a repeat of last month’s hysteria,” said Edward Bell, commodity analyst at Emirates NBD.

Brent crude, the international benchmark, settled 7.1 per cent higher at $34.81.

In Asia, stocks edged higher, with Japan’s benchmark Topix rising 0.4 per cent despite data confirming the country slipped into recession in the first quarter. Hong Kong’s Hang Seng index gained 0.6 per cent while China’s CSI 300 index rose 0.3 per cent.