What 2020 Taught Us About The Stock Market

getty

2020 was brutal in several strategies:

- Nearly400,000 Us citizens have been killed by COVID-19.

- Unemployment peaked at 14.7%, the greatest due to the fact the Fantastic Depression.

- Hundreds of hundreds of corporations failed, and complete industries, this kind of as travel and places to eat, were devastated.

- GDP contracted at a stunning 31.4% annualized rate in the next quarter, and the whole-yr GDP for 2020 was a destructive 3.5%, the worst 12 months considering that Globe War II.

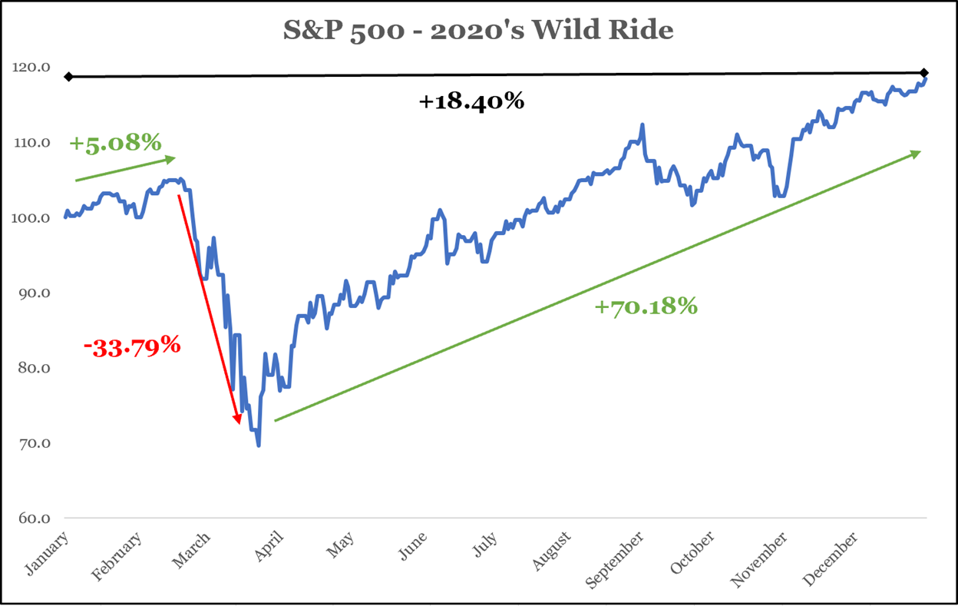

Despite all this negative information, the stock sector had a fantastic 12 months. After experiencing the swiftest 30% fall in record, the S&P 500 rebounded 70%, ending the year with an 18.4% whole return.

Credit: The St. Louis Have confidence in Enterprise Facts from Morningstar

What can we understand from this? 2020 emphatically verified two elementary concepts of the inventory market.

Theory 1: The foreseeable future is extremely hard to forecast

On December 31, 2019, I was at a occasion at a rental in Vail and put in the initial week of the 12 months snowboarding. I was seeking ahead to another lovely yr – a steadily increasing business enterprise, holidays and vacation, and a total social everyday living. Considering again to that 7 days is unnerving due to the fact I experienced no thought what was coming.

As we seem in advance to 2021, we really don’t have any greater thought of what the long run holds than we did a calendar year ago. That uncertainty can make us uncomfortable, so experts maintain forecasting stock sector returns to soothe us. As I not long ago wrote in my article What Will The Inventory Market Return in 2021, we really should overlook skilled predictions simply because they are only ever correct by incident, and they are furthest off the mark when we require them most.

Theory Two: The stock current market is not the economic system

That the financial state is tanking or booming doesn’t necessarily mean the stock current market will do the exact same. 2020 verified that the economy and the stock industry can head in various instructions.

In March of 2020, I published an write-up in Forbes titled Why The Looming Economic downturn Does not Mean You Really should Market Out Of The Inventory Market, building the point that the stock current market is not the overall economy and that the two only correlate really weakly. So the economy moving into a recession didn’t portend that stock returns would be bad. Due to the fact that posting was released, the stock market has received 45%, and folks have asked me how I knew it experienced nearly bottomed. The dilemma misses the issue: I didn’t know what the market place would do. It went up. It could have gone down. I did not know. And I nevertheless really don’t.

The Inventory Marketplace is A Advanced Adaptive Technique

In July 2020, I posted the posting Why The Inventory Industry Doesn’t Make Any Sense which describes that the stock current market is a intricate adaptive process. Viewing the sector this way clarifies why it can be up when a pandemic is raging and why it’s extremely hard to forecast what it will do.

In a sophisticated adaptive system, understanding each and every ingredient doesn’t help us realize the results of the method as a entire. System-level results are normally better than the sum of the elements simply because the method is composed of heterogeneous actors (termed agents) who interact with just about every other in strategies that can not be predicted. In a complicated adaptive procedure, brokers learn and change their behavior—sometimes rationally and often irrationally—as situation modify. Their switching habits can produce opinions loops as the output from just one end result turns into the enter to the next iteration. Damaging opinions usually results in steadiness, when constructive responses can amplify compact steps into massive and unexpected functions. Constructive responses loops develop method-broad outcomes that can not be predicted by observing the individual steps of the agents.

Putting the Ideas into Exercise

It is disconcerting that we can’t know what will transpire in the inventory industry due to the fact we have developed to glimpse for patterns that aid us predict the foreseeable future. It is a single of our primary survival mechanisms.

Nevertheless, it is liberating to recognize that there is no position in minutely subsequent the market and reacting to every single piece of news. It is vital to embrace the uncertainty and hold a major photograph look at if you want to invest efficiently.

Here’s a tale that illustrates why. Throughout the 1st week of March 2020, I experienced my very last facial area-to-deal with shopper meeting prior to the shutdown. At that point, the stock marketplace was in cost-free tumble, and my shopper was trying not to panic. At some issue in the discussion, she made the stage that “nobody could see this coming.” I advised her that I had been subsequent the pandemic intently when it was continue to in China and had read posts by infectious disorder authorities that predicted it would make its way to the U.S. and spread. So, we did have some advance warning. She appeared at me incredulously and requested, “Well, then why didn’t you do something? Why didn’t you have us promote out of the market place?” I informed her that we did not recommend customers to sell out of the sector due to the fact we would not know when to inform them to get again in the industry. It was very likely that by heading to money, our consumers would skip the rebound when it came. The moment you are in cash, it is a ton more challenging psychologically to place it to work when items are terrifying than it is to continue to be invested. Issues turned out well for her and our other purchasers. They did not sell out of the industry, and they entirely participated in the market’s remarkable restoration.