What next for a volatile Wall Street?

What next for a volatile Wall Street?

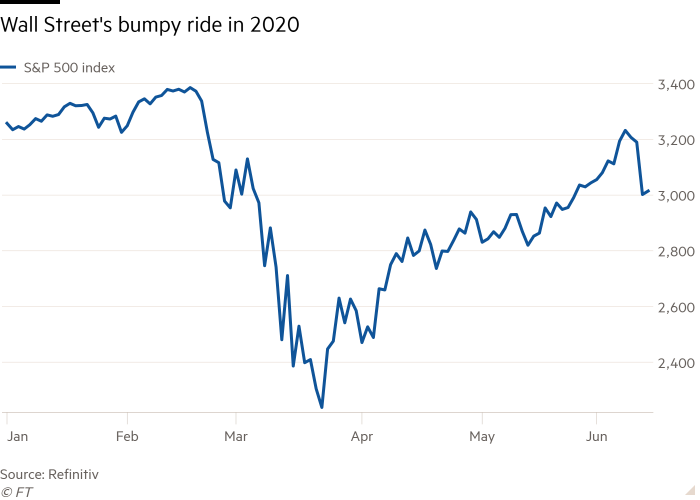

Violent swings returned to the US stock market last week. The S&P 500 index at one point climbed into positive territory for the year, only for investors to then witness the heaviest sell-off since the big collapse in March.

The Cboe volatility index — known as Wall Street’s “fear gauge” — jumped from 25 points on Monday to more than 42 points by Friday.

But the pullback was not totally unexpected. The US market had soared about 30 per cent since the trough, driven in part by record amounts of central bank and government stimulus, leading to worries the rally had become too detached from economic reality.

On the question of whether equity investors cared about fundamentals, analysts at Rabobank said it was “clear they currently don’t”. The analysts cited a backdrop of the World Bank “calling a deep global recession” and the worst US economic downturn since the 1930s, among other factors.

Shutdowns to curtail the spread of the pandemic have claimed the jobs of tens of millions of Americans, sapping business activity and leading to a drop in corporate profits. A first-quarter slide in earnings for companies in the S&P 500 is set to continue in the second, while many businesses are withdrawing the guidance that investors often rely on to gauge the trajectory of profits.

Second-quarter figures due to be reported next month will be “shocking,” said Bill Blain, market strategist at Shard Capital. “As the recession bites, and unemployment rises . . . markets could experience a serious reality check.”

In recent weeks, however, the rally had expanded beyond the tech and healthcare stocks that powered the early rebound. Cyclical stocks such as energy companies had begun to outpace the broader market — a sign the rally was strengthening and could even endure, said Michael Mullaney, global head of research for Boston Partners, a fund manager.

But Bank of America is less sanguine. The S&P 500 is currently above 3,000 points but the bank’s new year-end target is 2,900. Its analysts highlight the threat of a second Covid-19 wave and “US election risks”.

Richard Henderson

What extra measures has the BoJ got up its sleeve?

A big change in direction from the Bank of Japan’s meeting on Monday and Tuesday this week is unlikely. But governor Haruhiko Kuroda — just like his peers at other major central banks — is expected to give a show of determination to tackle the fallout of the coronavirus crisis.

Japan has already revealed its largest supplementary budget and a significant increase in government bond issuance to go along with it. Some clarity is expected from Mr Kuroda over how aggressively the BoJ will buy longer-dated JGBs with maturities over 25 years. Prices in that part of the market have been weak recently, sending yields on the 30-year bond to their highest level in a year.

Naoya Oshikubo, an economist at SuMi Trust, argues that the BoJ will “aim to impress” at this month’s meeting, and may double the size of a loan scheme for small and medium-sized companies.

“Going forward, the BoJ’s monetary policy will be swayed by new cases of Covid-19,” Mr Oshikubo said. “As such, it is very likely that we will see large-scale monetary and fiscal co-ordination as part of corporate funding measures.”

Leo Lewis

Will the Bank of England steer the pound lower?

Recent strength in the pound against the dollar could be lost if the Bank of England takes a step into the unknown at its policy meeting on Thursday.

Sterling has recovered against the dollar from its multi-decade lows of $1.15 in March to trade near $1.28 in the second week of June, benefiting from brighter tone in global markets that has pushed down the haven US currency.

But that trend was broken at the end of the week, when stock market nerves resurfaced and the UK economy was later shown to have collapsed by 20 per cent in April alone. The pound retreated closer to $1.25.

The UK currency has barely budged against the euro for a month. Clearly, much here hinges on the path of the dollar. Still, the BoE has the power to knock it lower still.

The central bank has already slashed its key interest rate to near zero in response to the pandemic, but speculation has moved on to whether it might consider moving rates below zero — a debate that gained momentum after senior BoE policymakers said they were at least contemplating the possibility.

Analysts expect the bank to steer clear of rate cuts at Thursday’s meeting, opting instead for an expansion of its asset purchasing programme. George Buckley, an economist at Nomura, said the BoE is likely to add an extra £150bn to its quantitative easing scheme, giving policymakers breathing space to monitor the economic recovery in the UK.

Thomas Flury, a strategist at UBS Wealth Management, said he saw “little to no chance” of negative rates at this meeting, noting that such a decision would “hammer” the pound.

But talk of negative rates will continue to haunt sterling. Analysts at RBC Capital Markets said late last month that the BoE will eventually make that leap, probably in November.

Eva Szalay