Is the stock market due for a correction in 2021? Here’s what some experts think

A pullback for the Dow Jones Industrial Ordinary and the S&P 500 index on Tuesday halted the longest gain streak for shares in months, but a big concern for traders stays: Is there a major correction looming in advance?

Even some bullish investors have identified as for a retrenchment in stocks as a sort of catharsis for the upcoming leg greater and an unwind of some of the frenzied, retail-inspired betting that has consistently sent shares to new records amid the COVID-19 recovery.

A temporary pullback that started in late January, tied to the trading fervor around GameStop Corp.

GME,

and AMC Entertainment Holdings

AMC,

observed markets exam some brief-phrase bullish craze strains, but lately the marketplaces have managed to claw again to create not-unspectacular returns in the early goings of a yr chock-complete of uncertainties.

The Dow Jones Industrial Ordinary

DJIA,

is up 2.5% so far in the year, the S&P 500

SPX,

is enjoying a more pronounced acquire of around 4%, whilst the Nasdaq Composite

COMP,

and Russell 2000

RUT,

indexes on Tuesday notched their 10th file closes in 2021 as a result significantly.

The year-to-date gains in the large-cap Nasdaq, up 8.7%, and the Russell 2000, up 16.4%, reflect an odd convergence of trader bets: These wagering on further prosperity in COVID-examined, big-capitalization development stocks that worked in the aftermath of the pandemic in the U.S. back again in March, alongside bets for a sizable rebound in tiny-cap, economically sensitive shares represented in the Russell.

In both case, cautious investors and these worried that the excellent periods just can’t very last forever are bracing for the subsequent significant slump for shares, and ruminating on how it may well participate in out.

Previously this week, Morgan Stanley’s Michael Wilson instructed CNBC during an job interview that “It was temporary, so if you blinked you missed it,” referring to the pullback in stocks in late January.

“That looks like that was it for now, and I mean, the markets are pretty strong at the second, and they have been,” Wilson mentioned.

“There’s great liquidity, there’s a extremely good and extremely easy to understand story behind the scenes. Indicating, we’ve received a robust financial restoration which is obvious to everyone. The earnings season’s been very good so far…and persons have acquired into it,” the Morgan Stanley analyst stated.

He cautioned, nevertheless, that the sector stays in a “a bit of a fragile point out,” and warned that leverage swirling in the procedure could make pullbacks of 3% or 5% far more of the norm.

Wilson did say, even so, that the re-emergence of person buyers in monetary markets would be a power to be reckoned with, and that they at present depict the marginal consumer on Wall Road preserving asset costs buoyant.

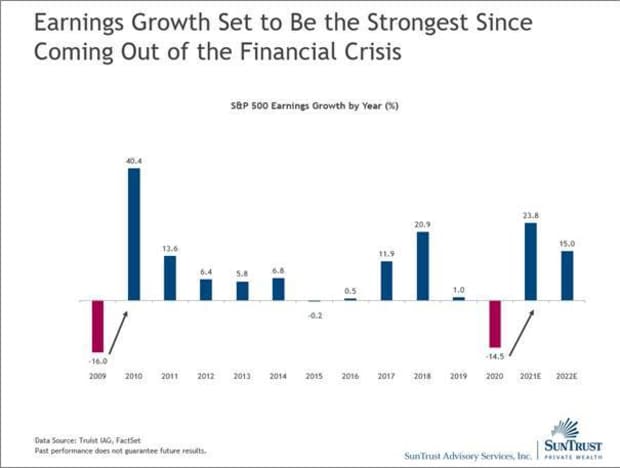

Keith Lerner, chief sector strategist at Truist Advisory Products and services, explained that problems of a inventory bubble are overdone and not supported by the existing batch of fourth-quarter earnings success, which his company estimates will be the ideal considering that the 2008 financial disaster.

Truist Advisory Products and services Inc./SunTrust Advisory Expert services Inc.

“Although there are frothy segments of the marketplace that are detached from fundamentals, we do not see bubble circumstances a lot more broadly,” Lerner wrote in a analysis report dated Tuesday.

“Instead, we see a stock market that is buying and selling at a top quality to historic valuations—partly justified by very low rates, a shift in sector composition towards bigger-valued expansion sectors, supportive monetary and fiscal coverage, as well as more affordable obtain to marketplaces (i.e., secular decline in commissions and fund expenses),” the Truist analysts extra, noting that a lower barrier to entry for individual traders also was giving assistance for stock values.

In the meantime, Daniel Pinto, a co-president at JPMorgan Chase & Co., told CNBC in a Q&A that he expects the inventory market to grind higher.

“I feel the market will slowly grind up through the calendar year,” he advised the news network. “I do not see a correction anytime soon, until the condition modifications dramatically,” he said, describing achievable downturns as mini corrections that won’t always alter the all round bullish pattern.

What could modify matters?

Naeem Aslam, chief current market analyst at AvaTrade, in a Tuesday report stated that optimism in the U.S. industry is pushed by 3 actors: Support from monetary and fiscal policy, development in COVID vaccinations and the good quarterly outcomes.

“Basically, it would seem like the stars are receiving in line, and there are powerful odds stacked in favour of another bull rally,” Aslam wrote.

“In other words, we will need one thing significant transforming in the latest catalyst to shift the sector narrative among traders that can set off a small pullback—let by itself a severe correction,” he included.

MarketWatch’s William Watts writes that some gurus are pointing to the 2009 inventory industry as the closest parallel to the existing set up for equities. Quoting Tony Dwyer, chief market strategist at Canaccord Genuity, Watts pointed out that 2021 could play out extra like the postcrisis scenario found in 2010, which would point the way to a “solid year” for the current market, but with a bumpy ride thanks to “multiple initially-50 % corrections.”

Some of the bumpiness may possibly emanate from the bond sector, with the 10-year

TMUBMUSD10Y,

and 30-year Treasurys

TMUBMUSD30Y,

tests modern generate highs and placing some pressure on equities.

The so-termed reflation trade, exactly where yields increase and investors gravitate to investments that could possibly prosper in superior economic occasions, has supplied a number of wrong dawns for traders so considerably.