Mortgage Rate Decline Slowed By New Fee Charged By Fannie Mae And Freddie Mac

Update: FHFA has delayed till December 1, 2020, implementation of the charge talked over in this posting.

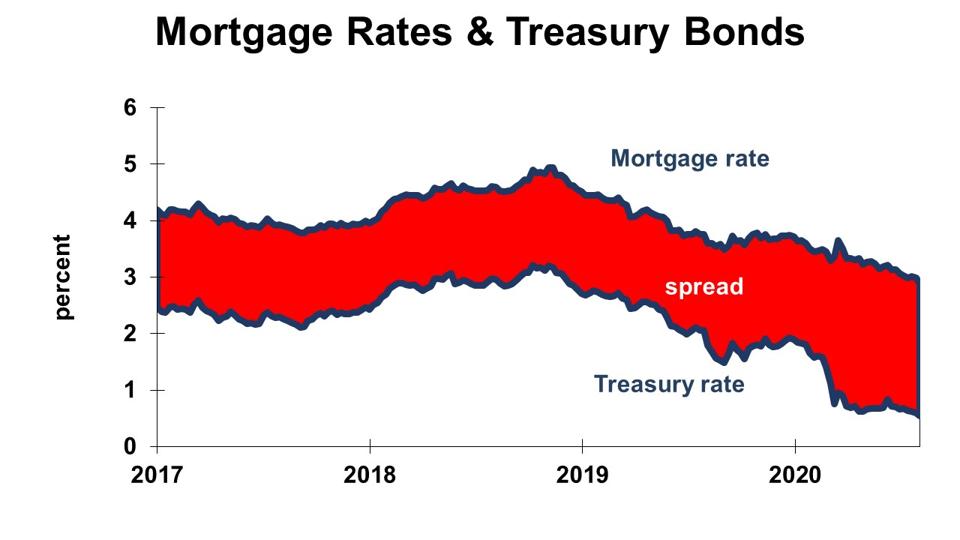

The interest price on mortgages has not fallen as significantly as the desire rate on 10-calendar year Treasury bonds

Mortgage loan refinance expenditures swung up because of to a new fee, which some are contacting a tax. The eventual route to reduce rates (which I not too long ago predicted) will be slowed, but not completely stopped. The bulletins by Fannie Mae and Freddie Mac say the lump-sum charge of one-fifty percent a percent of the bank loan stability applies to refinances on single family members homes. It does not utilize to design loans converting to lasting loans nor to mortgages for home purchase.

Fannie and Freddie are govt-sponsored enterprises, which is a minimal bewildering in by itself. They are enterprises, meaning they have income and loss statements. But they are government-sponsored, so their personal debt is handled type-of-like federal government personal debt. They can pay back lower interest prices than personal businesses would have to pay back. With that advantage, they have near-overall manage of the market place for mortgages that conform to their tips.

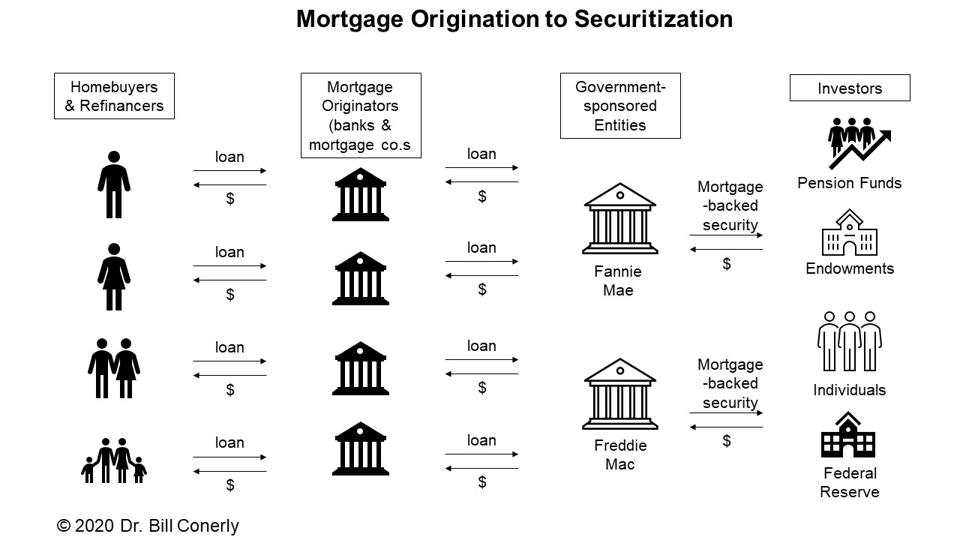

Curiosity rates on 30-calendar year mortgages generally operate at a steady premium above the desire premiums on 10-yr Treasury bonds. But early in 2020, the Treasury level plummeted devoid of mortgage charges pursuing along totally. This wider margin was explored in William Emmons’ article, “Why Haven’t House loan Costs Fallen Even further.” Most mortgages that conform to Fannie and Freddie’s bank loan guidelines are bundled in teams and marketed as home loan-backed securities. The course of action results in two spreads. At the retail stage, the curiosity fee charged to borrowers is greater than the desire charge paid to homeowners of the house loan-backed securities. The property finance loan originator—a lender or impartial mortgage company—pockets the distinction to deal with their expenditures and to earn a profit. The 2nd spread is known as the wholesale margin: the difference between the curiosity price acquired on mortgage-backed securities and what governing administration bonds are paying.

The home loan procedure from origination by means of securitization

Emmons’ investigation of details from the spring of 2020 located that most of the wider margin of retail home finance loan prices about treasury bond yields was due to retail unfold. Emmons verified to me by e mail that additional recent info go on that pattern. Essentially, the company that the home owner goes to for a refi is pocketing bigger profits. A portion of the greater revenue addresses increased expenditures of functioning all through the pandemic, but most of the income flows by means of to gains.

The new price is Fannie’s and Freddie’s endeavor to capture some of the income to create up their reserves. The immediate result was that mortgage loan rates jumped up, maybe out of anger or irritation by mortgage processors.

To figure out the effect of the cost on the house loan price that a standard refi purchaser is quoted, we start with simple supply and desire. In a normal textbook illustration, an maximize in costs by way of a tax or necessary rate is ordinarily handed by means of, partly, to consumers. Some of the tax simply cannot be handed via, so it lowers the seller’s gain.

Even so, this would not be the case if potential was restricted. Occasionally a seller can’t increase source, at minimum not as rapidly a demand is escalating. That is the situation now. The desire for refis grew massively when fascination premiums dropped, and the mortgage sector could not develop rapid enough. Home loan companies and banks could have turned consumers absent, but alternatively they lifted their financial gain margin.

In this sort of a situation, the tax would be borne entirely by the sellers and not at all by the individuals. If the home finance loan businesses bumped up their fees to protect the charge of the new price, some prospects would choose not to refinance. Home loan organizations would have unused capacity, and some would reduce premiums to carry clients again in. Competitiveness amid sellers would bring the price tag back down.

So at a place in time, this payment seems to be undesirable news just for house loan field earnings and not for homeowners wanting to refinance their home loan.

Having said that, the industry’s capability constraint is not set. In truth, the market has been growing as quickly as it could to provide the hundreds of thousands of persons wanting to refi. The new payment will decrease income, so the home finance loan marketplace will increase considerably less swiftly. That will slow the decline in home loan spreads. And spreads will never ever return to the lows they experienced beforehand witnessed, mainly because of the better value. So the charge appears to be benign for a working day or two, but not afterwards.

Property finance loan fees will go on to decline from the existing amount, but not as quick, nor as much, as would have took place if Fannie and Freddie not picked out to insert this payment.